Pharmaceutical Giant Secures Crucial Obesity Treatment Portfolio

In a dramatic corporate showdown that reached the highest levels of the U.S. government, Pfizer Inc. has emerged victorious in a fierce bidding war for control of promising obesity drug developer Metsera Inc. The pharmaceutical giant secured the takeover for as much as US$10 billion, marking a pivotal moment in the global race for weight-loss treatments.

The Late-Night Corporate Duel

The intense competition culminated on Friday evening when Pfizer CEO Albert Bourla received confirmation around 9 p.m. that Metsera's board had unanimously accepted his company's offer. The decision followed a high-stakes Wall Street confrontation that pitted Pfizer against Danish rival Novo Nordisk A/S, with both companies recognizing the deal would shape the pharmaceutical industry's hierarchy for years to come.

The battle gained unprecedented political dimensions when Novo Nordisk CEO Mike Doustdar publicly challenged Pfizer during a White House appearance alongside President Donald Trump on Thursday. "Our message to Pfizer is that if they would like to buy the company, then put your hand in your pocket and bid higher," Doustdar declared from the presidential podium.

Regulatory Intervention Turns the Tide

The takeover contest took a decisive turn when the U.S. Federal Trade Commission intervened directly in the proceedings. According to sources familiar with the matter, the FTC contacted Metsera on Friday to express serious concerns about any potential deal with Novo Nordisk. The regulatory warning followed an earlier formal letter sent to both companies earlier in the week.

Metsera's board convened immediately after receiving the FTC communication, with several members expressing apprehension about proceeding with Novo's offer given the regulator's opposition. Within hours, the board resolved to negotiate exclusively with Pfizer, and by 9:32 p.m., Metsera announced Pfizer had prevailed in the corporate contest.

The FTC's unusual decision to signal its position during an active bidding process represents the latest example of the Trump administration taking a more hands-on approach to corporate mergers and acquisitions.

Strategic Implications for Pharmaceutical Landscape

For Pfizer, the Metsera acquisition represents a crucial strategic victory. The company has seen its shares decline approximately 60% since their pandemic-era peak in late 2021, creating intense pressure on Bourla to identify new blockbuster products. Pfizer's obesity drug development efforts had suffered significant setbacks, including terminating one pill in June 2023 and abandoning another in April after a patient showed signs of liver injury.

Novo Nordisk, while disappointed, accepted the outcome gracefully. "I'm completely fine with this outcome," stated Doustdar, who had just returned to Europe from Washington. "Not doing a deal is better than doing one with bad returns. We win some, we lose some. Our defeat makes us stronger."

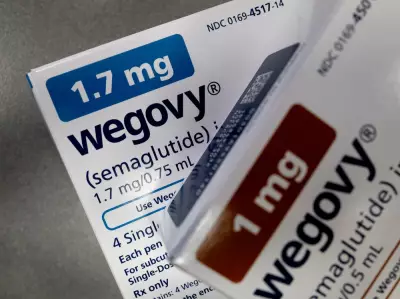

The obesity drug market has become increasingly competitive, with Eli Lilly & Co.'s Zepbound emerging as the most successful GLP-1 treatment for weight loss. Lilly is also expected to introduce one of the first oral GLP-1 medications by early next year, intensifying the race for market dominance.

The Metsera takeover underscores the extraordinary value major pharmaceutical companies place on securing new blockbuster treatments, particularly in the rapidly expanding weight-loss medication sector that represents one of the most promising markets in modern healthcare.