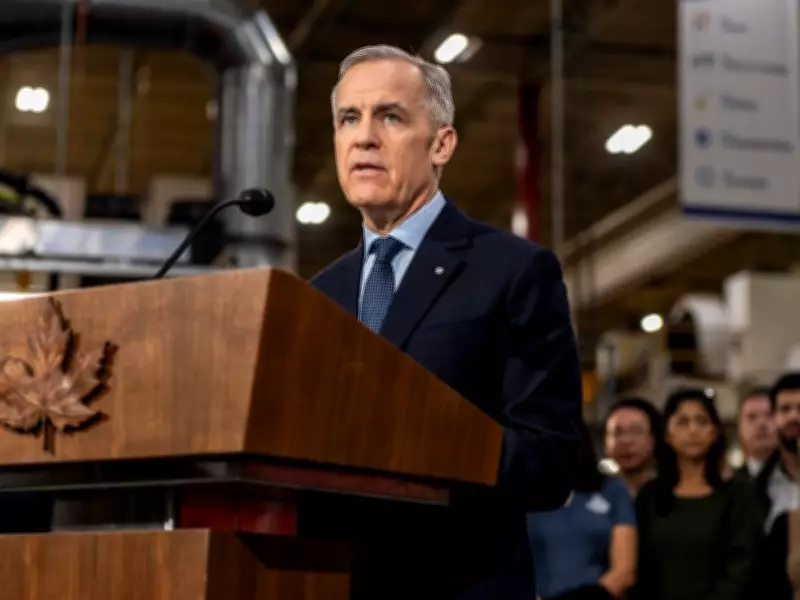

Carney's Electric Vehicle Strategy Faces Scrutiny Over Economic Realities

Prime Minister Mark Carney's recently announced auto industry strategy, which promises billions in support for Ontario's struggling vehicle manufacturers, appears at first glance to be a significant boost for the sector. However, a closer examination reveals that the electric vehicle-focused approach may do little to address the fundamental challenges facing Canadian automakers.

A Plan Untethered from Industry Realities

Critics argue that Carney's strategy is remarkably disconnected from the practical economic realities of the global automotive industry. The plan hinges on several questionable assumptions: that Ontario plants will suddenly produce electric vehicles they currently don't manufacture, that Canadian consumers will develop an immediate and dramatic appetite for EVs, and that a robust export market will materialize where none currently exists.

Adding to these concerns is the federal government's commitment to provide $2.3 billion in EV rebates that will primarily encourage Canadians to purchase vehicles manufactured outside Canada, with the notable exception of new Chinese imports.

Ontario's Marginal Position in EV Production

Canada's Ontario-centric auto manufacturing industry remains a marginal player in the electric vehicle sector. Currently, the only EVs produced in Ontario are the Dodge Charger muscle car and the Chrysler Pacifica minivan—both niche products priced above the $50,000 threshold that would exclude them from Carney's rebate program. This creates the paradoxical situation where billions in government rebates are essentially irrelevant to the domestic industry they're supposedly designed to support.

Market Limitations and Export Challenges

While Carney aspires to make Canada a global leader in EV production, the domestic market presents significant limitations. Canadians purchase approximately 1.8 million vehicles annually, with EVs currently comprising just 10 percent of that total. For an auto plant to operate cost-effectively, it typically needs to produce about 200,000 units of a single model each year—a volume that Canada's market alone cannot absorb.

The export market presents additional complications. The United States represents the only cost-effective export destination for Canadian automakers, but hostile American trade policies have placed even this traditional market in question. As Canadian Vehicle Manufacturers Association CEO Brian Kingston noted in a recent interview, access to the U.S. market is "fundamental to any auto strategy" but was not adequately addressed in Carney's announcement.

Industry Contraction Amid Government Ambition

Carney's plan arrives as the auto industry itself appears to be hitting the brakes on electric vehicle expansion. Several major manufacturers have scaled back or delayed their EV initiatives:

- Honda has postponed construction of a $15-billion battery and EV assembly plant in Alliston, Ontario

- Stellantis has significantly reduced its electric vehicle plans

- General Motors has halted production of its electric delivery van in Ingersoll, Ontario

- Ford has dropped several electric models, taken a substantial write-down, and shifted focus toward gas cars and hybrids

- Toyota continues to concentrate on hybrid technology rather than fully electric vehicles

Mixed Industry Reception

Despite these apparent flaws, Carney's plan has received a generally positive response from the auto industry. This reception stems largely from one key concession: the abandonment of the previous Liberal government's "wildly unachievable" target of having 100 percent of new passenger vehicle sales be electric by 2035.

The fundamental disconnect between Carney's ambitious political vision and the practical realities of automotive manufacturing raises serious questions about whether this strategy will benefit Canadian automakers or primarily serve political objectives. As the industry faces contraction and market uncertainty, the effectiveness of an EV-focused approach that doesn't align with production capabilities or market realities remains in doubt.