Global Markets Exhibit Caution as Trump's Federal Reserve Announcement Approaches

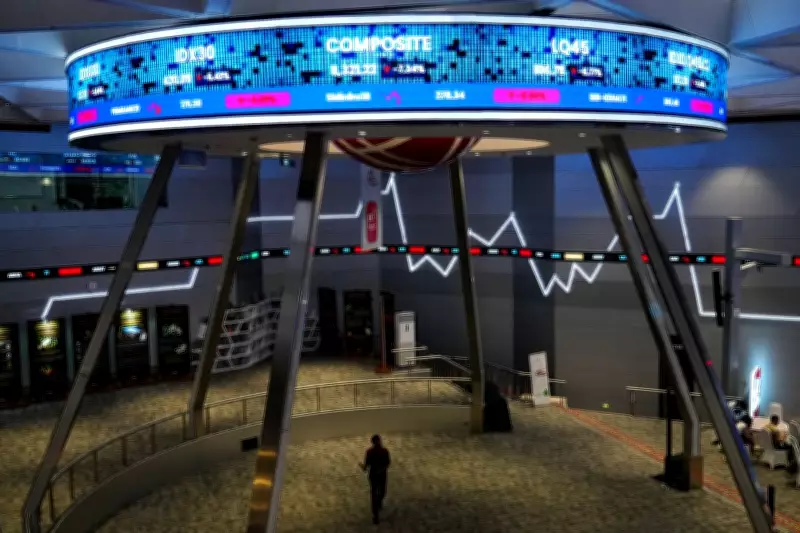

Financial markets worldwide are displaying a cautious and mixed pattern as investors brace for a significant announcement from former U.S. President Donald Trump regarding the leadership of the Federal Reserve. U.S. stock futures have notably declined in early trading, reflecting heightened uncertainty in North American markets. This anticipation is creating ripples across global exchanges, with Asian and European shares showing divergent performances as traders assess the potential implications of a change in the world's most influential central bank.

Market Volatility and Investor Sentiment

The prospect of Trump nominating a new Federal Reserve chair has injected a fresh wave of volatility into financial systems. Market analysts observe that this uncertainty is particularly affecting sectors sensitive to interest rate policies, including banking, real estate, and technology. The S&P/TSX composite index in Canada has experienced a slide, mirroring the unease seen in U.S. markets, while corporate earnings reports are adding another layer of complexity to investor calculations.

International shares are presenting a fragmented picture, with some indices gaining ground while others retreat, underscoring the global interconnectedness of financial markets. This mixed performance highlights how geopolitical and policy decisions in the United States can swiftly influence capital flows and investment strategies worldwide.

Broader Economic and Political Context

This market tension unfolds against a backdrop of other significant developments. In Canada, political figures are actively engaging on various fronts; for instance, Ontario Premier Doug Ford has publicly urged Alberta Premier Danielle Smith to counteract separatist sentiments within her province. Meanwhile, in the United States, Democrats and the White House are nearing a tentative spending agreement aimed at preventing a government shutdown, which could provide some stability if finalized.

On the corporate front, major energy companies are evaluating opportunities in northern Manitoba, indicating ongoing investment in Canadian resources. Additionally, the retail and consumer sectors continue to evolve, with trends like smart home products and budget-friendly beauty items gaining traction among Canadian shoppers.

Implications for Monetary Policy and Trade

The Federal Reserve plays a crucial role in shaping monetary policy, influencing interest rates, inflation control, and economic growth. A potential change in its leadership could signal shifts in policy direction, affecting everything from mortgage rates to currency values. This situation is particularly relevant for Canada, given the close economic ties and integrated financial markets between the two nations.

Investors and policymakers alike are closely monitoring these developments, as the outcome could have lasting effects on global economic stability. The coming days are likely to see increased market scrutiny and analysis as more details emerge regarding Trump's intentions and the qualifications of potential Fed chair candidates.