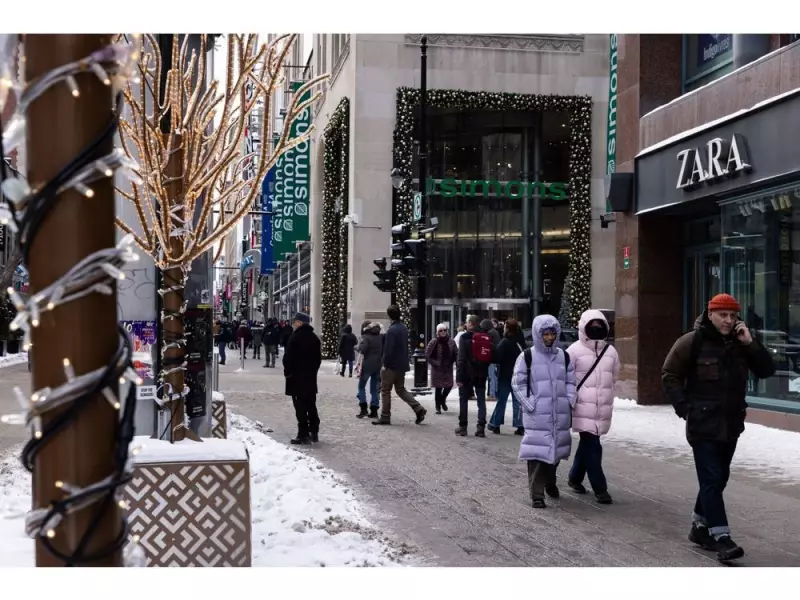

Canadian Retail Sales Reveal Stagnating Consumer Consumption Amid Economic Pressures

New data from Statistics Canada indicates that retail sales in the country are showing signs of stagnation, reflecting ongoing caution and financial pressure among Canadian consumers. The latest figures suggest that while there was some growth in the final quarter of 2025, the pace has slowed significantly compared to earlier in the year.

December Decline Follows November Gains

According to advance estimates released on Friday, retail receipts fell by 0.5 percent in December 2025. This decline came after a stronger-than-expected performance in November, where sales increased by 1.3 percent, surpassing the 1.2 percent gain forecast by economists in a Bloomberg survey.

When adjusted for price changes, retail sales volumes actually rose by 1.1 percent in November. However, the broader picture reveals a concerning trend: sales volumes have increased by just 1.5 percent over the previous year and have remained roughly flat since April 2025.

Fourth Quarter Growth Remains Anemic

Preliminary estimates suggest that retail sales grew by a modest 0.2 percent in the fourth quarter of 2025. While this represents a slight acceleration from the 0.1 percent gain recorded in the third quarter, it marks a significant deceleration from the more robust growth seen at the beginning of 2025.

The November sales increase was driven by gains in eight of nine retail subsectors. Food and beverage retailers led the way, with beer, wine, and liquor retailers experiencing a substantial 14.3 percent jump as labor disruptions ended in British Columbia. Motor vehicle and parts sales saw a 0.3 percent increase, while gasoline sales rose by 2 percent.

Multiple Headwinds Challenge Consumer Spending

Several macroeconomic factors are contributing to the cautious consumer behavior. U.S. tariffs have negatively impacted exports, dampening overall economic optimism. With unemployment standing at 6.8 percent, the labor market remains soft, creating uncertainty for many households.

Additional pressures include a shrinking population and families renewing mortgages at higher interest rates. These conditions collectively point to continued challenges for the retail sector in the coming months.

Interest Rate Relief Provides Some Support

On a more positive note, the Bank of Canada implemented interest rate cuts totaling 100 basis points during 2025, providing some relief for borrowers. However, the central bank has signaled a prolonged pause in further rate adjustments, with markets and most economists expecting policymakers to maintain current rates for much of 2026.

The combination of these factors creates a complex economic landscape for Canadian retailers and consumers alike, with cautious spending patterns likely to persist in the near term.