Alkane Resources Limited, a mining company listed on the ASX, TSX, and OTCQX, has released its Quarterly Activities Report for the period ending December 31, 2025, showcasing impressive financial and operational results. The company, based in Perth, Australia, reported a substantial increase in cash and bullion, alongside record production figures, highlighting a strong performance in the second quarter of fiscal year 2026.

Operational Highlights and Financial Performance

During Q2 FY26, Alkane achieved a site operating cash flow of $133 million, contributing to a notable rise in its cash, bullion, and listed investment balance. The company ended the quarter with $246 million in these assets, marking a $58 million increase from the previous period. This financial strength was bolstered by an additional $18 million payment received in early January from a Costerfield concentrate shipment, delayed due to the Christmas holidays.

Record Production Metrics

Alkane set a new benchmark with its highest quarterly production to date, yielding 42,767 ounces of gold and 267 tonnes of antimony. This translates to a group record of 43,663 gold equivalent ounces, a significant jump from the 30,511 AuEq oz produced in Q1 FY26. The all-in sustaining cost (AISC) for this period was $2,739 per gold equivalent ounce, down from $2,988 in the prior quarter, indicating improved efficiency.

The production surge was driven by enhanced output at the Tomingley operation and the full integration of Björkdal and Costerfield mines, following the merger with Mandalay in August 2025. In total, Alkane processed 683,235 tonnes of ore at an average gold grade of 2.20g/t Au, with Tomingley contributing 318,851 tonnes at 2.50g/t, Costerfield at 10.44g/t gold and 0.91% antimony over 34,732 tonnes, and Björkdal at 1.04g/t over 329,652 tonnes.

Exploration and Development Updates

Exploration efforts yielded promising results, with extension drilling at Storheden, part of the Björkdal property, doubling the depth and strike extent of the known system. Notable intercepts included 142.0 g/t gold over 0.60 m and 111.0 g/t gold over 0.50 m. At Tomingley, a gold-rich domain was discovered near McLeans, with assays showing 4.36g/t gold over 26m, including a high-grade zone of 22.8 g/t over 3.3m.

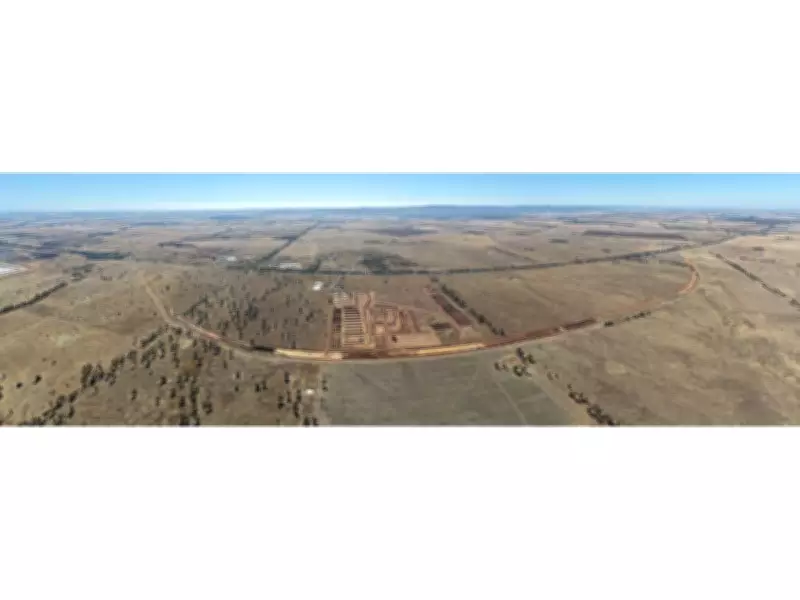

In terms of infrastructure, Tomingley was awarded the final contract for constructing the Newell Highway re-alignment, with completion expected in the first half of 2027, supporting future operational logistics.

Sales and Corporate Financials

Gold equivalent sales for the quarter reached 44,084 ounces, generating revenue of $256 million at an average gold price of $5,785 per ounce and an average antimony price of $41,510 per tonne. The company also filled 8,200 ounces of hedges during the period, managing price risks effectively.

Management Commentary and Outlook

Nic Earner, Managing Director of Alkane, expressed satisfaction with the quarter's performance, stating, "It has been an excellent quarter for Alkane, producing 42,767 ounces of gold and 267 tonnes of antimony over the full quarter. Our site operating cashflow was $133 million, resulting in a balance sheet with $246 million in cash, bullion, and listed investments at quarter end." He reaffirmed the full-year guidance of 160,000 to 175,000 gold equivalent ounces at an AISC of $2,600 to $2,900 per ounce, reflecting confidence in ongoing operations at Costerfield and Björkdal.

Alkane's strong quarterly report underscores its operational resilience and financial health, positioning the company for continued growth in the competitive mining sector. With robust production, strategic exploration successes, and a solid cash position, Alkane remains on track to meet its annual targets, offering a positive outlook for investors and stakeholders alike.