Vancouver's emerging exploration company, Evergold Corp., has taken a significant step forward in advancing its flagship DEM gold prospect with the announcement of a strategic $350,000 financing deal. The non-brokered private placement, structured as a convertible debenture, comes from prominent investor CJ Greig, signaling strong confidence in the project's potential.

Strategic Funding for Critical Exploration

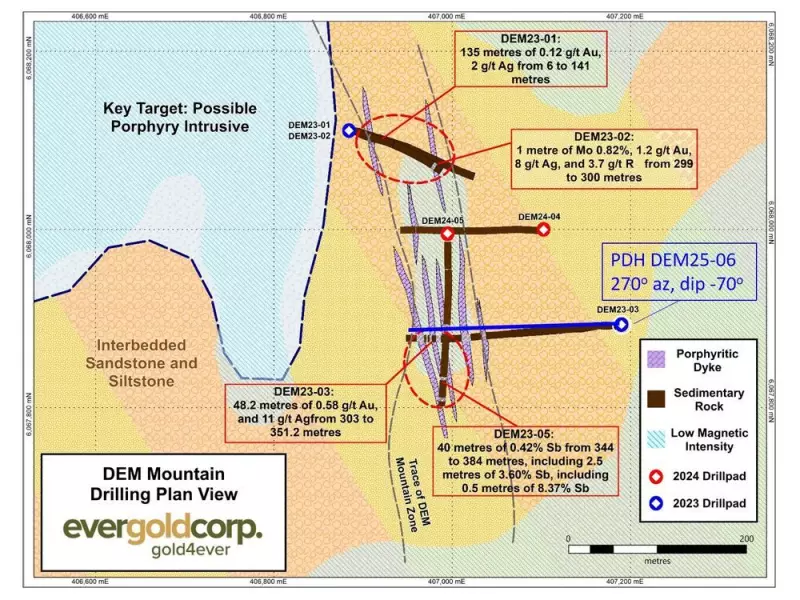

The convertible debenture financing provides Evergold with immediate capital to launch an aggressive drilling campaign scheduled to begin in early November. This timing positions the company to capitalize on favorable weather conditions in British Columbia's prolific Golden Triangle region, where the DEM gold prospect is located.

Investor Confidence in Golden Triangle Potential

CJ Greig's decision to personally back Evergold through this private placement underscores the compelling geology and exploration upside identified at the DEM property. The Golden Triangle has historically produced world-class mineral deposits, and Evergold's technical team believes the DEM prospect shares similar geological characteristics with known high-grade gold systems in the region.

Accelerated Timeline for Value Creation

With financing now secured, Evergold can immediately mobilize drilling equipment and crews to site. The upcoming program represents a critical milestone in validating the geological model developed through previous surface sampling and geophysical surveys. Successful results from this initial drilling could significantly enhance the project's valuation and attract broader market attention.

Positioning for Discovery Success

The DEM gold prospect represents one of the most promising early-stage opportunities in Evergold's portfolio. The company's systematic approach to exploration, combined with this strategic injection of capital, positions shareholders for potential discovery-driven value appreciation as drilling commences in the coming weeks.