Alamos Gold Announces Major Expansion of Island Gold District Operation

Alamos Gold Inc. has unveiled significant expansion plans for its Island Gold District operation in Ontario, positioning it to become one of Canada's premier gold mining assets. The company released results from its Expansion Study, which outlines a substantial increase in production capacity and mineral reserves.

Expansion Details and Production Increases

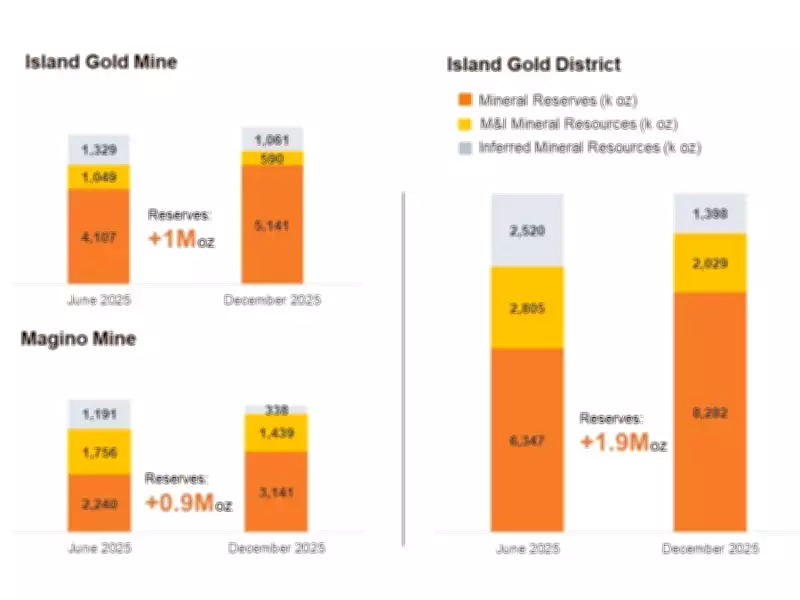

The expansion involves scaling up the Magino mill to process 20,000 tonnes per day, representing a major capacity increase. This includes processing 3,000 tonnes per day of high-grade underground ore alongside 17,000 tonnes per day from the open pit operation. Compared to the Base Case Life of Mine Plan released in June 2025, this expansion incorporates a 30% increase in Mineral Reserves.

John A. McCluskey, President and Chief Executive Officer of Alamos Gold, emphasized the significance of this development: "The evolution and growth of Island Gold continues with another substantial increase in Mineral Reserves supporting another high-return expansion of the operation. The IGD Expansion is starting to unlock the true potential of the Island Gold District."

Key Economic and Operational Highlights

The expansion study reveals impressive economic metrics and operational improvements:

- Production Increase: Average annual production of 534,000 ounces over 10 years post-expansion (2028+), representing a 27% increase from the Base Case LOM

- Cost Structure: Average mine-site All-In Sustaining Costs of $1,025 per ounce over the initial 10 years post-expansion, approximately 31% lower than 2025 levels

- Mineral Reserves: Total reserves increased to 8.3 million ounces across 128.2 million tonnes, with underground reserves at Island Gold showing particularly strong grades

- Mine Life: 19-year operational timeline maintained despite increased mining and processing rates

Financial Impact and Future Potential

The expansion has dramatically increased the operation's value, with the net present value reaching $12.2 billion at gold prices of $4,500 per ounce. This represents substantial growth from the combined acquisition cost of $1.4 billion for both Island Gold and Magino. The project demonstrates a 69% after-tax internal rate of return, highlighting its strong economic viability.

McCluskey further noted the ongoing exploration success: "Given our significant ongoing exploration success within the main Island Gold structure and spectacular high-grade results we are seeing within the nearby Cline-Pick targets, we are confident there is further growth and upside to come."

Reserve Breakdown and Operational Details

The expanded mineral reserves include:

- Island Gold Underground: 5.1 million ounces grading 10.61 grams per tonne across 15.1 million tonnes, representing a 25% increase from the Base Case LOM

- Magino Open Pit: 3.1 million ounces grading 0.86 grams per tonne across 113.1 million tonnes, showing a 40% increase from the Base Case LOM

The operation maintains its 19-year mine life while significantly increasing both underground and open pit mining rates. Over a 15-year period with both operations running, average annual production is projected at 490,000 ounces based on current mineral reserves.

This expansion solidifies the Island Gold District's position as one of Canada's largest and most economically attractive gold mining operations, with industry-leading cost structures and substantial growth potential through ongoing exploration activities.