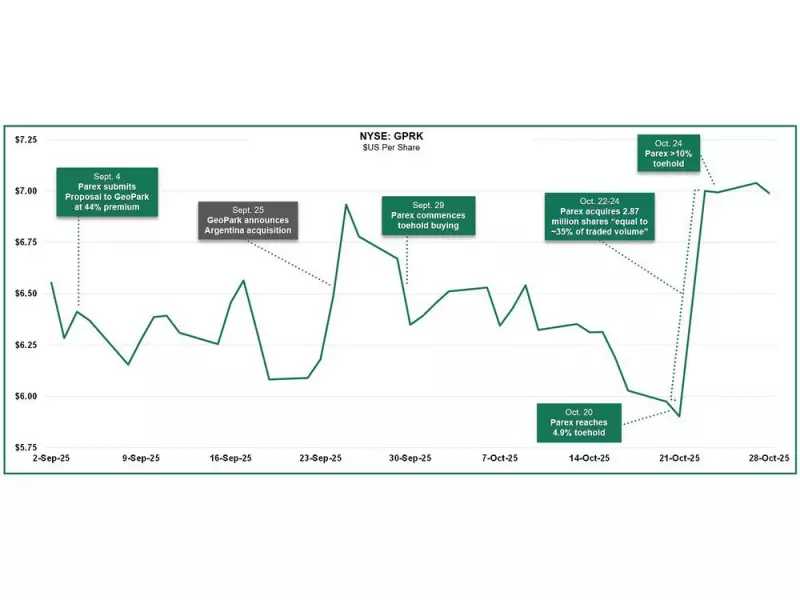

In a significant development shaking up the Canadian energy landscape, Parex Resources has unveiled a strategic proposal to acquire fellow energy producer GeoPark Limited. The Calgary-based company simultaneously disclosed it has already accumulated a substantial 11.8% ownership position in GeoPark, signaling serious intent behind the acquisition bid.

Strategic Expansion in Latin American Energy Markets

The proposed acquisition represents a major consolidation play within the oil and gas sector, particularly focused on Latin American operations. Parex Resources, known for its strong presence in Colombia, sees the potential combination as a transformative opportunity to create enhanced value for shareholders of both companies.

This move comes at a time when energy companies are increasingly seeking strategic combinations to strengthen their market positions and operational capabilities. The acquisition would significantly expand Parex's footprint across key Latin American energy markets where both companies maintain substantial assets and production capabilities.

Building on Established Success

Parex Resources has built a reputation as one of Canada's leading international energy companies, with a focused strategy on sustainable growth and shareholder returns. The company's existing 11.8% stake in GeoPark demonstrates its confidence in the target company's assets and management team.

The proposed transaction is positioned as a natural evolution of both companies' strategic objectives, combining complementary asset portfolios and operational expertise across multiple jurisdictions in Latin America.

Market Implications and Future Outlook

This acquisition proposal arrives during a period of renewed consolidation activity within the global energy sector. Industry analysts are watching closely as the deal could set the tone for further merger and acquisition activity among mid-sized energy producers with international exposure.

The combination of Parex's operational excellence with GeoPark's established asset base creates the potential for significant synergies and enhanced competitive positioning in the evolving global energy landscape.

As the proposal moves through the evaluation process, stakeholders in both companies await further details about the specific terms and strategic vision behind what could become one of the more notable energy sector transactions of the year.