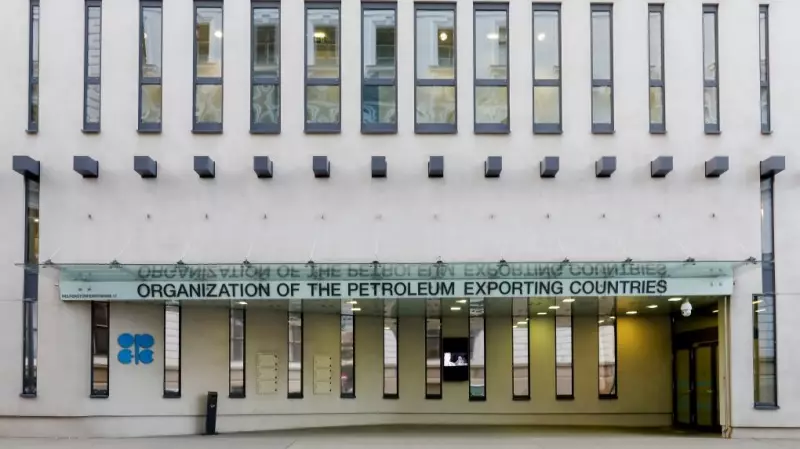

OPEC+ Poised to Continue Production Pause as Oil Prices Rise

According to sources familiar with the matter, the OPEC+ alliance is expected to maintain its current pause on increasing oil production when it meets in early March. This decision comes as global crude prices have shown a steady upward trend in recent weeks, providing the group with little incentive to alter its output strategy.

Market Conditions Support Continued Caution

The organization, which includes major producers like Saudi Arabia and Russia, has been carefully managing supply to support market stability. With benchmark prices climbing above recent lows, analysts suggest the coalition will likely extend its production restraint to avoid undermining the fragile recovery. This approach reflects a continued commitment to balancing global supply with demand, particularly amid ongoing economic uncertainties in key consuming regions.

Strategic Implications for Global Energy Markets

The anticipated decision underscores OPEC+'s pivotal role in shaping international energy dynamics. By holding production steady, the alliance aims to prevent price volatility while ensuring adequate revenue for member nations. This strategy has become increasingly important as geopolitical tensions and shifting demand patterns create additional complexities in the oil market.

Industry observers note that maintaining the production pause could help sustain current price levels, benefiting both producers and consumers by providing more predictable market conditions. However, some analysts caution that prolonged restraint might eventually lead to tighter supplies, potentially pushing prices higher in the coming months.

Broader Context of Energy Policy

This development occurs alongside significant shifts in global energy policy, including increased investment in renewable alternatives and evolving consumption patterns. OPEC+'s decisions continue to influence not only crude markets but also broader economic indicators and inflation trends worldwide.

The final decision will be confirmed during the group's upcoming meeting, where members will assess market data and coordinate their approach for the second quarter. While the production pause appears likely, unexpected factors could still influence the outcome, highlighting the ever-changing nature of global energy markets.