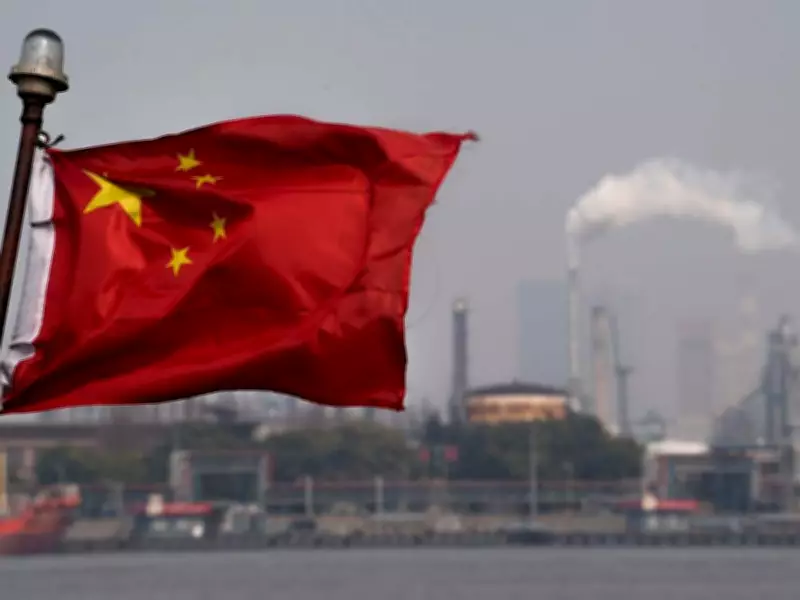

Chinese Refiner Shifts Focus to Canadian Crude Amid Venezuela Supply Disruption

One of China's most significant regular purchasers of Venezuelan crude oil has begun actively pursuing Canadian cargoes as a strategic replacement. This shift comes in response to recent United States intervention in Venezuela, which has dramatically upended global oil flows and contributed to rising prices in certain markets.

Specific Bid Details for Canadian Cold Lake Oil

According to industry sources familiar with ongoing negotiations, Shandong Chambroad Petrochemicals Co. has formally offered to purchase Canadian Cold Lake oil at a discount of approximately US$5 per barrel relative to ICE Brent crude prices. This offer is structured on a delivered basis to China for May shipments. The individuals providing this information requested anonymity as they are not authorized to speak publicly about the matter.

It is important to note that no final agreement has been reached at this stage. Market traders indicate that recent transactions involving this specific grade of Canadian crude were concluded with Chinese buyers at slightly narrower discounts of around US$4 per barrel to the ICE Brent benchmark.

Background: The Venezuela Supply Squeeze

The private Chinese refiner's bid emerges as China actively explores alternatives to Venezuela's Merey crude, a heavy oil variety that historically traded at substantial discounts due to extensive U.S. sanctions. The situation intensified following former President Donald Trump's blockade and the subsequent seizure of tankers involved in transporting Venezuelan oil through clandestine networks.

These actions have significantly reduced oil flows destined for China, with Western traders redirecting shipments primarily to European markets and the Caribbean region. Consequently, the discounts offered to Asian buyers have narrowed considerably compared to previous arrangements.

Historical Price Context and Market Impact

Prior to the recent U.S. measures, when Venezuelan oil was sold through covert channels, barrels were frequently offered to Chinese refiners at discounts as substantial as US$15 per barrel. The current shift toward Canadian crude at much smaller discounts illustrates how geopolitical developments can rapidly alter global energy trade patterns and pricing structures.

Shandong Chambroad Petrochemicals has not responded to requests for comment regarding these market movements. Attempts to contact the company via telephone also went unanswered.

Broader Chinese Market Participants

Beyond privately-owned Chambroad, other established Chinese buyers of Venezuelan crude are likely monitoring this evolving situation closely. These include significant industry players such as Shandong Dongming Petroleum & Chemical Group and Sinochem Hongrun Petrochemical Co., though their specific responses to the supply disruption remain unclear at this time.

The ongoing realignment highlights how Canada's energy sector may benefit from changing geopolitical dynamics, even as global markets adjust to new supply realities and pricing mechanisms.