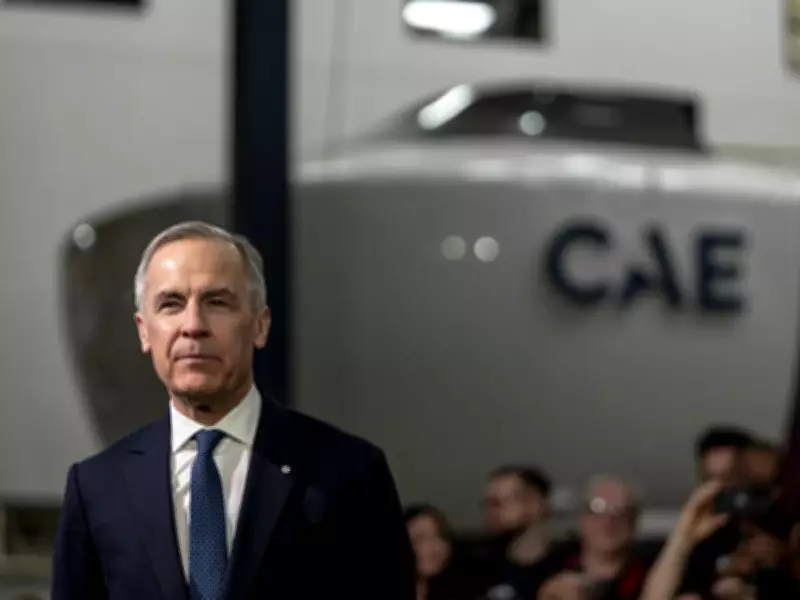

TSX Stocks Poised to Benefit from Mark Carney's Defence Industrial Strategy

The Canadian stock market is abuzz with opportunities stemming from Prime Minister Mark Carney's newly announced defence industrial strategy. This comprehensive plan, backed by substantial financial commitments, is set to reshape the investment landscape for TSX-listed companies. Alongside this, market movements in stocks like Shopify Inc. highlight broader trends in technology and resource sectors.

Shopify's Remarkable Rebound and Analyst Confidence

Shopify Inc. (SHOP:TSX) demonstrated a strong recovery, closing the week with a 10 per cent gain, positioning it among the top performers on the S&P/TSX composite index. This rebound comes as investors reassess their initial reactions to the company's earnings report released on February 11. Despite achieving its highest quarterly revenue in two decades, concerns over adjusted earnings per share misses and general apprehension about artificial intelligence initially drove shares down by as much as 27 per cent intraday.

Analysts have rallied in support of Shopify. CIBC Capital Markets analysts Todd Coupland and Dylan Ridout maintained Shopify as a top pick, setting a price target of $250, slightly reduced from $271. They emphasized the company's potential for durable profitable growth and its strategic integrations with leading AI platforms like OpenAI, Google's Gemini, and Microsoft's Co-pilot, which they argue positions Shopify to benefit rather than be displaced by these technologies.

Jefferies Equity Research analysts Samad Samana and Jeremy Sahler expressed surprise at the negative stock price movement post-earnings. Following the report, multiple investment firms reaffirmed their price targets, contributing to the stock's recovery. Shopify closed Friday at $172.89, with the average 12-month price target from 46 analysts tracked by Bloomberg standing at $215.02.

Defence Industrial Strategy: A Boon for Canadian Companies

Prime Minister Mark Carney's defence industrial strategy involves $180 billion in procurement and $290 billion in defence capital investment over the next decade. A key aspect of this strategy is the prioritization of contracts for Canadian companies, aiming to bolster domestic industries.

Desjardins Group Capital Markets analysts Benoit Poirier and Michael Kypreos highlighted the positive implications for covered companies, noting the strong Buy Canada focus and targeted sectors. They estimate that dedicating approximately 70 per cent of defence spending to Canadian firms could provide an annual boost of $5.1 billion, translating to roughly 300 defence contracts per year.

Companies identified as potential beneficiaries include:

- Bombardier Inc. (BBD:TSX): Expected to gain from the aerospace sector's inclusion as a priority.

- CAE Inc. (CAE:TSX): Positioned to benefit from specialized manufacturing, training, and simulation.

- Calian Group Ltd. (CGY:TSX): Also set to gain from training and simulation initiatives.

- MDA Space Ltd. (MDA:TSX): Anticipated to benefit from advancements in space-based intelligence, surveillance, reconnaissance, and satellite communications.

- Kraken Robotics Inc. (PNG:TSX): Could see wins in autonomous systems, aligning with Ottawa's plans for a drone innovation hub funded with $105 million over three years.

MDA has already taken steps by launching a wholly owned defence company, 49North Ltd., while company selections for the drone hub are expected this summer.

Uncovering Value in Behind-the-Headline Stocks

Beyond the immediate headlines, there are lucrative opportunities in less prominent stocks. Mehmet Beceren of Rosenberg Research & Associates Inc. advocates for a theme-based stock screening system that moves beyond headline names to identify second- and third-tier companies. These firms may be less crowded, have less priced in, and offer better positioning as market themes mature.

Copper serves as a prime example of such a theme. With prices soaring due to supply constraints, a weaker U.S. dollar, and geopolitical risks, copper miners have seen significant gains. Rosenberg Research has developed a global copper miner supply chain basket comprising 24 companies, including TSX-listed names such as:

- Finning International Inc. (FTT:TSX)

- Fortis Inc. (FTS:TSX)

- Mattr Corp. (MATR:TSX)

- Major Drilling Group International (MDI:TSX)

- Orbit Garant Drilling Inc. (OGD:TSX)

This basket also includes companies from Australia, the U.S., Mexico, Japan, Sweden, and Germany. Year-to-date, this supply chain basket has outperformed a generic copper miners portfolio, indicating that second- and third-order effects are beginning to materialize as investors seek diversified and better-priced exposure to popular themes.

In summary, the TSX is poised for dynamic shifts driven by policy initiatives and market trends. Investors should monitor defence-focused stocks and explore value in thematic investments to capitalize on these evolving opportunities.