Ontario Resident Defrauded of $260,000 in Sophisticated 'Pump-and-Dump' Scheme

An Ontario man from Richmond Hill has reported a devastating financial loss of $260,000 after falling victim to a classic yet increasingly sophisticated 'pump-and-dump' investment scam. The case, which emerged in late January 2026, serves as a stark warning to Canadian investors about the persistent dangers of fraudulent stock market schemes.

How the 'Pump-and-Dump' Scam Operated

The victim, identified as Israel Klait, was ensnared by a scheme where fraudsters artificially inflate the price of a stock—often a low-value or obscure security—through false and misleading positive statements. This 'pumping' phase creates a buzz, enticing investors like Klait to buy shares at inflated prices. Once the price peaks, the scammers swiftly 'dump' their own holdings for a substantial profit, causing the stock to collapse and leaving other investors with significant losses.

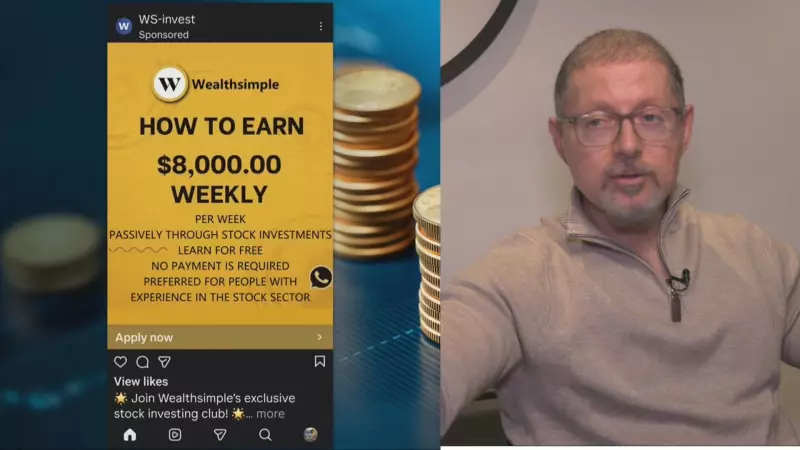

These scams frequently leverage aggressive marketing tactics, including unsolicited calls, social media hype, and fabricated news reports, to create an illusion of a 'hot' investment opportunity. In Klait's case, the precise methods used to lure him in have not been fully disclosed, but the outcome underscores the emotional and financial toll such fraud can inflict.

A Growing Concern for Canadian Investors

While 'pump-and-dump' schemes are not new, they have evolved with technology, becoming more pervasive through online platforms and digital communication channels. Financial regulators in Canada, including the Ontario Securities Commission (OSC), consistently warn the public about these manipulative practices. Key red flags investors should watch for include:

- Unsolicited investment offers with promises of guaranteed high returns

- Pressure to act quickly on a 'once-in-a-lifetime' opportunity

- Stocks promoted through spam emails, social media posts, or boiler-room calls

- Limited publicly available information about the company

Klait's loss of $260,000 is a significant sum that highlights how even experienced investors can be duped. It reinforces the need for due diligence and skepticism when evaluating investment opportunities, especially those that seem too good to be true.

Protecting Yourself from Financial Fraud

To mitigate risks, consumers are advised to:

- Verify the registration of any investment advisor or firm with provincial securities commissions

- Research companies thoroughly using independent sources before investing

- Avoid making decisions based solely on promotional materials or anonymous tips

- Report suspicious activities to authorities like the Canadian Anti-Fraud Centre

This incident in Richmond Hill is a sobering reminder that financial scams can target anyone, regardless of location or background. As investment markets grow more complex, staying informed and cautious remains the best defense against predatory schemes aiming to exploit unwary participants.