As the holiday season intensifies, a University of Calgary academic is urging shoppers to exercise caution with popular 'Buy Now, Pay Later' (BNPL) payment options. Professor Alex Bierman warns these services, while offering short-term relief, can lead to increased spending and longer-term financial anxiety.

The Psychology Behind the 'Buy Now, Pay Later' Temptation

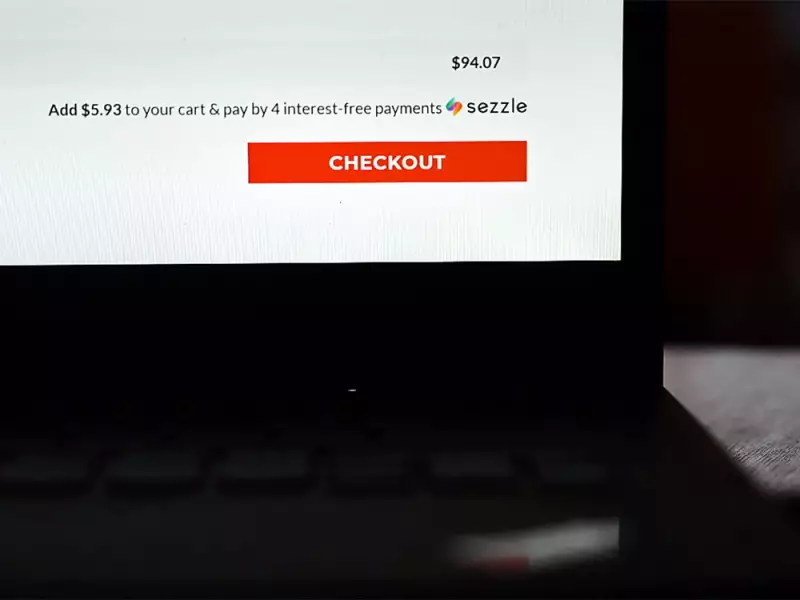

BNPL plans, offered by fintech companies like Affirm, Klarna, Afterpay, Sezzle, and PayBright, allow consumers to purchase items immediately and pay for them in smaller installments over time, often interest-free. A common structure is paying in four installments over six weeks.

According to Alex Bierman, a professor in the UCalgary Department of Sociology, the appeal is deeply psychological. "When you see a smaller amount of money that you’re paying per installment, it essentially doesn’t feel like you’re paying as much," Bierman explains.

He cites research indicating this perception directly influences behavior. "What research has shown is that people are more likely to make purchases when they use BNPL, and additionally, they're more likely to spend more. That’s because of this psychology of BNPL, where it doesn’t seem like you’re paying as much."

Who is Most Vulnerable to BNPL This Season?

Bierman identifies two groups particularly drawn to these services, especially in the current economic climate marked by inflation and high costs: younger adults and those feeling financially constrained.

For individuals on the lower end of the pay scale, who have been squeezed by years of high inflation, BNPL can appear as a lifeline to participate in holiday traditions. "Around the holiday season, they also feel obligated to give gifts to people," Bierman notes. "BNPL may be one way to continue with holiday traditions such as gift giving or feeling like they’re not excluded from these holiday traditions."

The Hidden Cost: Financial Stress and Isolation

While BNPL can provide a temporary sense of control and inclusion, the professor highlights a significant downside. The relief is often fleeting, giving way to the reality of accumulated debt. "Because of that psychological benefit, it’s easy to lose sight of the larger picture that ultimately there is a larger cost to pay, and they can actually find that they’ve set themselves farther back financially," Bierman cautions.

This financial strain has broader psychological repercussions. 'People often feel a psychological hit from financial stress,' says the professor. This stress can lead to feelings of marginalization and isolation, which are amplified during festive periods like Christmas and New Year's when social and financial pressures peak.

Bierman concludes that while BNPL services can offer a short-term path to participate in holiday giving, consumers must be acutely aware of the long-term financial commitment they are creating. The immediate psychological reward of a smaller payment can obscure the total cost, potentially leading to a post-holiday financial hangover that exacerbates stress rather than alleviates it.