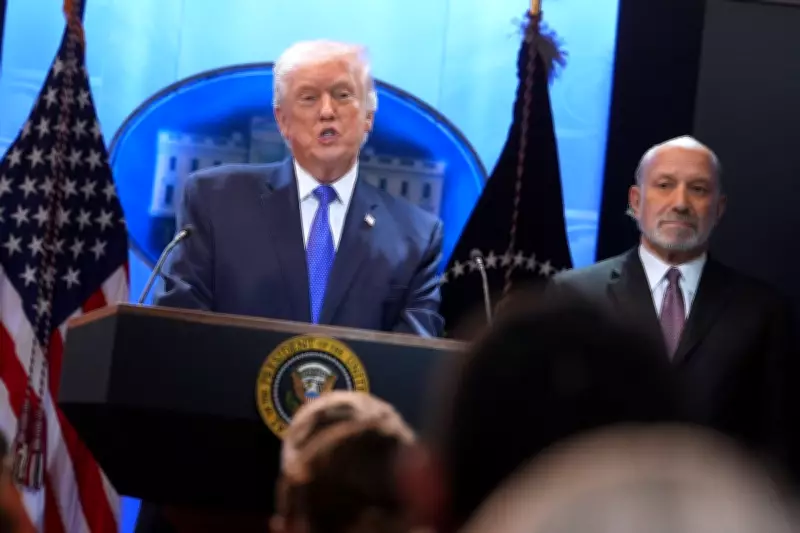

JPMorgan Chase Confirms Account Termination for Donald Trump Post-January 6

In a significant corporate disclosure, JPMorgan Chase has conceded that it closed financial accounts belonging to former U.S. President Donald Trump following the January 6, 2021, attack on the Capitol. The banking giant's admission sheds light on the heightened risk evaluations undertaken by major financial institutions in the turbulent aftermath of the insurrection.

Corporate Risk Management in a Politicized Climate

The decision by JPMorgan underscores the complex landscape where corporate governance intersects with political and reputational risk. Financial institutions routinely assess client relationships based on legal, regulatory, and reputational factors. The events of January 6, which involved a violent breach of the Capitol by Trump supporters contesting the 2020 election results, prompted widespread scrutiny of entities associated with the former president.

JPMorgan's move aligns with a broader trend of businesses reevaluating ties to politically contentious figures. While banks do not typically publicize specific client decisions, this acknowledgment highlights the tangible consequences of the Capitol attack on Trump's commercial relationships. The bank has not detailed the exact timing or specific accounts involved, but the closure represents a notable step in corporate risk mitigation.

Context and Implications for Financial Sector

The January 6 attack led to multiple investigations, legal proceedings, and a second impeachment of Trump, though he was later acquitted by the Senate. In this environment, corporations faced pressure to distance themselves from individuals linked to the unrest. JPMorgan's action reflects a cautious approach to managing potential fallout, including regulatory concerns and public perception.

Other financial institutions have also reportedly reviewed their engagements with Trump and affiliated entities, though few have made public statements. The episode illustrates how geopolitical events can directly influence banking decisions, particularly for high-profile clients whose actions may pose reputational or legal risks.

For Trump, whose business empire includes real estate, branding, and political fundraising, access to banking services is crucial. Account closures by major banks could complicate financial operations, though he retains relationships with other institutions. The situation underscores the evolving standards for corporate accountability in an era of heightened political polarization.

Broader Corporate and Political Repercussions

JPMorgan's disclosure may prompt further scrutiny of how businesses navigate political affiliations. In recent years, companies have increasingly taken public stands on social and political issues, balancing stakeholder expectations with commercial interests. The bank's decision highlights the practical ramifications of such positioning, especially when involving former heads of state.

As legal and congressional investigations into January 6 continue, additional corporate actions related to Trump and his associates may emerge. The financial sector's response serves as a barometer for the enduring impact of the Capitol attack on American institutional norms.