Global Markets React to Federal Reserve's Decision to Hold Interest Rates Steady

Global financial markets experienced a day of mixed trading on Wednesday, January 29, 2026, following the U.S. Federal Reserve's announcement to maintain its current interest rate levels. The decision, widely anticipated by investors, prompted a surge in gold prices while stock indices around the world showed divergent movements.

Gold Prices Climb as Investors Seek Safe Havens

The price of gold jumped significantly in the wake of the Fed's announcement, reflecting a classic flight to safety among investors. This precious metal, often viewed as a hedge against economic uncertainty, benefited from the central bank's cautious stance. Market analysts note that the steady rates signal a continued focus on managing inflation without stifling growth, which can bolster demand for assets like gold in volatile times.

Stock Markets Exhibit Mixed Performance

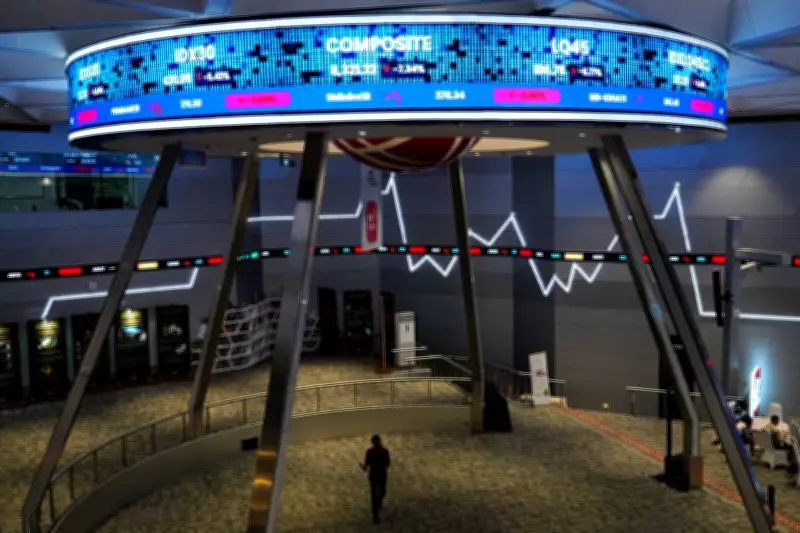

Equity markets responded with a varied performance. In the United States, major indices such as the S&P 500 and Nasdaq traded in a narrow range, ending the session with modest gains in some sectors and losses in others. Meanwhile, international markets, including exchanges in Asia and Europe, also displayed a lack of uniform direction. For instance, the Jakarta Stock Exchange Composite Index in Indonesia saw fluctuations, as depicted in recent trading sessions, highlighting the global ripple effects of U.S. monetary policy.

Economic Context and Future Outlook

The Federal Reserve's decision to keep rates unchanged comes amid ongoing assessments of economic indicators, including inflation data and employment figures. By holding steady, the Fed aims to balance the need for price stability with supporting economic expansion. This approach has led to a cautious optimism among some investors, though concerns about future rate hikes or cuts linger. Experts suggest that market volatility may persist as traders digest further economic reports and central bank communications in the coming weeks.

In summary, the global financial landscape remains sensitive to U.S. monetary policy shifts, with gold's rise and mixed stock trading underscoring the complex interplay of risk and opportunity in today's economy.