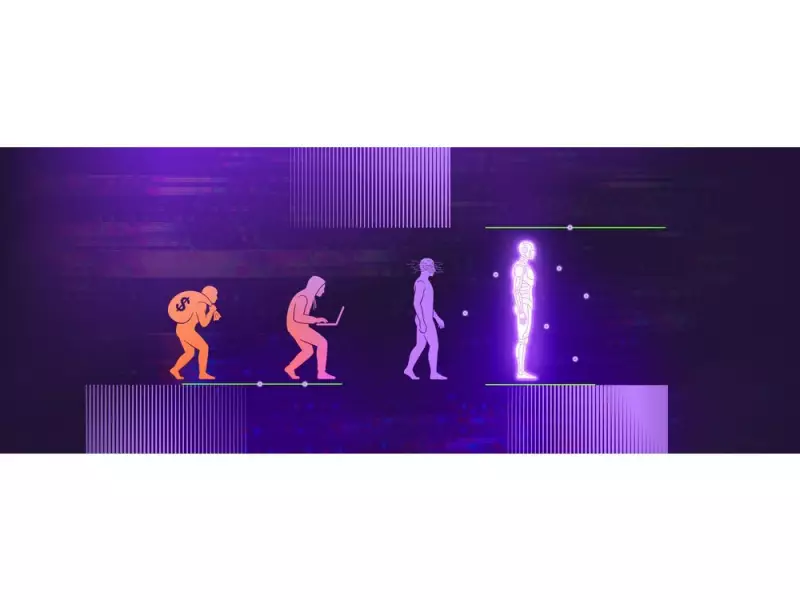

The Evolution of Identity Verification: Beyond Human Boundaries

RESTON, Va., Nov. 20, 2025 - The fundamental nature of identity verification is undergoing a radical transformation that extends far beyond authenticating human users. According to a groundbreaking new report from Regula, businesses must completely rebuild their verification processes to address emerging threats from sophisticated AI systems and automated fraud networks.

The identity threat landscape has entered what experts describe as an industrial phase, characterized by three fundamental shifts that are redefining security protocols across industries.

The New Face of Digital Fraud

Identity verification is no longer confined to confirming human identities. The landscape now includes autonomous systems and AI agents capable of opening accounts, submitting documents, and bypassing security checks without human intervention. This expansion into machine identity represents one of the most significant challenges for security professionals.

Fraud has evolved into a service industry, with complete persona kits including synthetic faces, voices, and detailed backstories available for purchase. Deepfake technology and impersonation fraud have moved from specialized skills to mainstream services, making sophisticated identity theft accessible to even novice cybercriminals.

Perhaps most concerning is the emergence of coordinated AI attacks where networks of artificial intelligence systems work in concert to overwhelm verification systems. One model fabricates documents while another impersonates individuals during live video verification, with a third system learning from each failed attempt to improve future attacks.

Shifting from Pattern Recognition to Origin Verification

As the distinction between human and machine identities becomes increasingly blurred, the fundamental purpose of verification is changing. Ihar Kliashchou, Chief Technology Officer at Regula, emphasizes that trust now begins at the source rather than at the checkpoint. The traceable origin of documents, images, or digital signals is becoming as crucial as the content itself.

The battle against fraud is evolving from simple pattern recognition to comprehensive origin verification. Security systems must now answer not just whether something appears real, but where it originated and how it was created. This represents a fundamental shift in how organizations approach digital trust and security.

The Emerging Trust Stack and Verification Standards

Verification is transforming from a compliance exercise to an accountability framework. As algorithms make increasingly important decisions, businesses must ensure their systems maintain transparency, auditability, and explainability. Compliance is no longer about checking boxes but about establishing operating standards that can withstand sophisticated attacks.

Organizations are responding by consolidating fragmented verification tools into unified end-to-end identity verification platforms. These systems orchestrate document checks, biometric authentication, and screening procedures under a single policy layer. According to Kliashchou, disconnected verification tools represent not just technical limitations but significant compliance risks.

The concept of identity is expanding to include machines, algorithms, and self-authenticating systems that operate independently. The rise of machine customers capable of signing documents, conducting transactions, or negotiating terms requires new frameworks to trace every digital actor back to a responsible entity. This represents the birth of a new digital identity paradigm that will define security and trust in the coming years.