A Calgary woman reliant on provincial disability benefits says she is being blocked from accessing a crucial federal tax credit because she cannot afford the fee her doctor charges to complete the necessary paperwork.

Financial Barrier to Essential Support

Karrie Payne, a 55-year-old Calgarian, has required disability support since a 2014 car accident left her with post-traumatic fibromyalgia, chronic pain, osteoarthritis, and tendonitis in her hips. She receives $662 per month from Alberta's Assured Income for the Severely Handicapped (AISH) program and an additional $1,239 from the Canadian Pension Plan disability, for a total monthly income of $1,898.

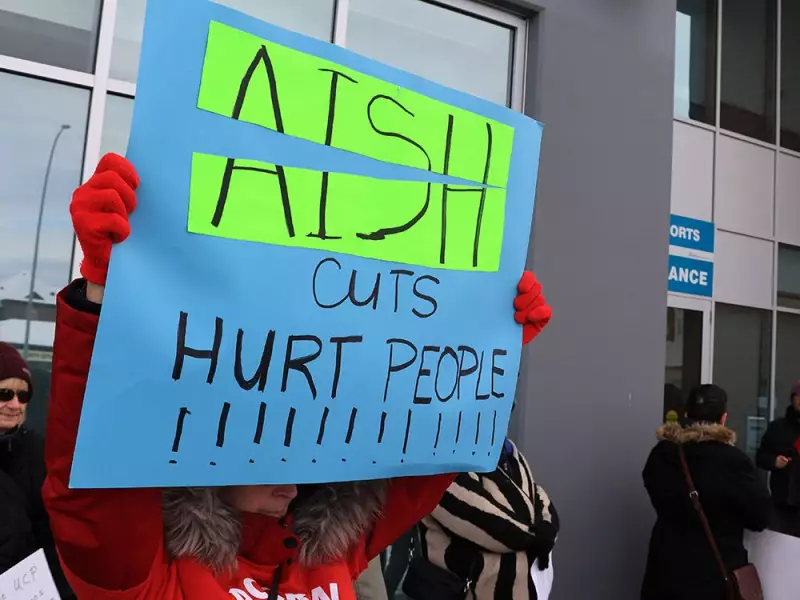

Payne now faces a critical deadline. The Alberta government requires individuals in the AISH program to apply for the federal disability tax credit by February 28, 2025, to avoid a $200 monthly deduction from their support. This deduction would claw back the new Canada disability benefit introduced by the federal government.

However, Payne's path to applying is blocked by a cost she cannot bear. Her doctor at the Shawnee Medical Health Center in southwest Calgary charges a $420 fee to fill out the Disability Tax Credit certificate, a mandatory form that must be submitted to the Canada Revenue Agency (CRA) for approval.

"There's no way I can pay that," Payne stated, recalling her reaction when a clinic staff member informed her of the fee.

Unregulated Fees Create Inequity

The situation highlights a significant gap in the system. While healthcare providers are essential for verifying a patient's disability for the CRA, the province does not set or mandate a fee for this service. Providers are free to set their own rates, which can vary dramatically based on the complexity of the patient's condition and the anticipated work involved.

Doug Manderville, former president of the Voice of Albertans with Disabilities, called the $420 fee "a little extreme." He noted that typical fees he has heard of range from $50 to $150 in Calgary, and between $50 to $100 in Lethbridge.

"It could have something to do with the nature of the disability and how detailed it has to be," Manderville suggested, acknowledging that more complex cases might require more physician time.

The director of Shawnee Medical Health Center declined to comment on Payne's specific case or confirm the fee, citing patient confidentiality policy.

Implications of Missing the Deadline

For Payne and thousands of other Albertans with disabilities, the stakes are high. Successfully applying for and receiving the federal disability tax credit would protect the $200 monthly Canada disability payment from provincial clawbacks. However, it is important to note that approval could still result in a corresponding reduction in an individual's AISH allowance, as the programs interact.

The requirement places individuals on limited fixed incomes in an impossible position: pay a significant upfront fee they likely cannot afford, or face a guaranteed reduction in their monthly support. With the February 28 deadline looming, the pressure is mounting for vulnerable Albertans.

Payne's experience underscores a systemic issue where administrative costs create barriers to essential financial supports for people living with disabilities, forcing them to choose between paying for medical documentation or losing vital income.