Federal Government Announces GST Credit Enhancement as Parliament Reconvenes

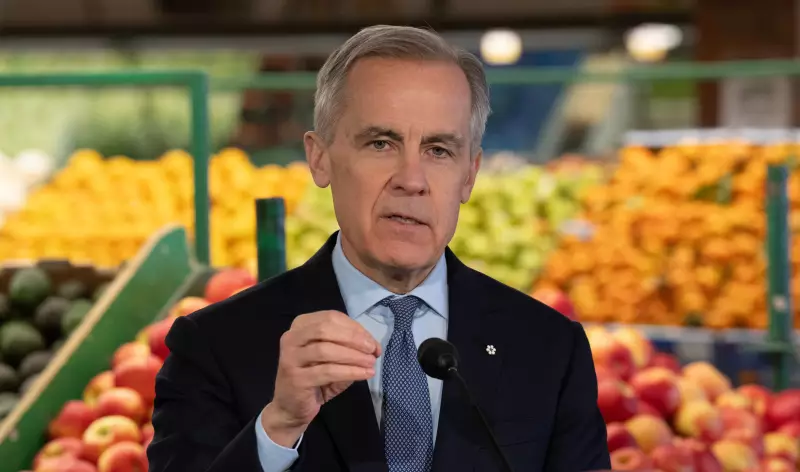

As the House of Commons resumed its legislative duties this week, the federal government led by Prime Minister Mark Carney unveiled a substantial boost to the Goods and Services Tax (GST) credit. This initiative, presented as the Groceries and Essentials Benefit, aims to provide immediate financial relief to Canadians grappling with ongoing cost-of-living challenges.

Addressing Affordability Through Direct Support

Prime Minister Carney emphasized the government's commitment to assisting citizens during difficult economic times. "Canadians take care of each other in times of need," Carney stated during the announcement. "This enhanced GST credit is designed to help families and individuals manage their essential expenses, particularly for groceries and daily necessities."

The specific details regarding the exact increase in credit amounts and eligibility criteria are expected to be outlined in upcoming parliamentary discussions. However, government officials have indicated that the enhancement will be implemented swiftly to ensure timely support reaches households across the country.

Political Context and Election Speculation

The announcement comes amidst heightened political activity as Parliament returns from recess. When questioned about potential implications for a spring election, Prime Minister Carney firmly dismissed such speculation. "You can't draw that conclusion at all," he asserted, redirecting focus to the government's legislative agenda.

Carney also referenced his recent comments at the World Economic Forum in Davos, noting they "laid out how we see the world" and the government's approach to global economic challenges. The GST credit boost appears aligned with this perspective, positioning direct consumer support as a key component of domestic economic policy.

Broader Economic Landscape and Expert Perspectives

While the GST credit enhancement has been welcomed by many advocates for low and middle-income Canadians, some economic experts caution that such measures alone may not fully address systemic affordability issues. As one analyst noted, "The GST credit hike won't solve affordability challenges alone," suggesting that complementary policies addressing housing, healthcare, and wage growth may be necessary for comprehensive solutions.

The government's announcement coincides with other significant developments, including ongoing discussions about international trade tensions and domestic fiscal management. However, the immediate focus remains on implementing this consumer-focused measure as Parliament begins its new session.

As legislative debates unfold in the coming weeks, further details about the GST credit enhancement and its integration into broader economic strategy are anticipated to emerge, shaping the political and financial landscape for Canadians nationwide.