Budget Watchdog Exposes Unprecedented Definition of 'Capital' in Carney Government's Accounting

In a striking revelation before a parliamentary committee, Canada's interim Parliamentary Budget Officer has declared that the Carney government's definition of "capital spending" finds no parallel in any other advanced economy worldwide. This unconventional accounting approach has raised significant concerns about transparency and fiscal responsibility in federal budgeting practices.

Questionable Classification of Billions in Spending

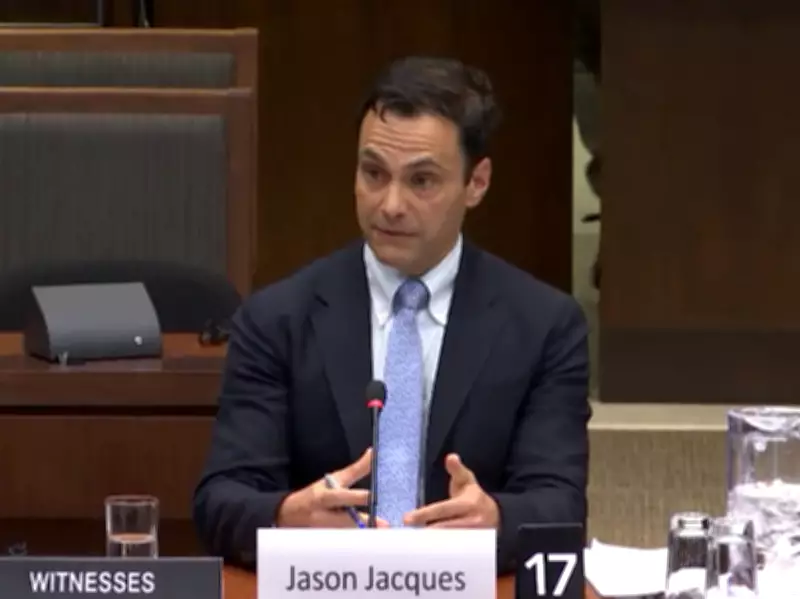

During testimony before the Standing Committee on Government Operations and Estimates, Jason Jacques, the interim Parliamentary Budget Officer, was directly questioned about whether other nations follow Canada's newly adopted policy of categorizing items like subsidies and tax credits as "capital" investments. His response was unequivocal: "We are unaware of any advanced jurisdictions that would define capital in that way."

Jacques specifically highlighted the Carney government's classification of corporate income tax credits as "capital" in their 2025 budget documents. He further noted that "there are other measures as well, including operating subsidies provided to companies ... that's not really seen in other jurisdictions." This unconventional approach potentially affects up to $92 billion in federal spending that would typically be considered operational expenses in comparable developed economies.

Political Context and Campaign Promises

The controversy stems from Prime Minister Mark Carney's campaign platform, which prominently featured the slogan "Spend Less, Invest More." This approach promised a new federal accounting framework that would distinguish between "operational" and "capital" spending. The government committed to balancing the operational budget within three years while treating capital investments as long-term assets requiring different fiscal considerations.

Despite these promises, the 2025 federal budget contained what Jacques described as the "single largest non-crisis deficit in the country's history" at $78.3 billion. The Carney administration defended this substantial deficit by characterizing much of the spending as "generational capital investments" rather than conventional federal expenditures.

Persistent Concerns from the Budget Office

The Parliamentary Budget Officer has expressed ongoing concerns about this accounting methodology for several months. In a November report analyzing the 2025 budget, the PBO criticized the Carney government's "overly expansive" definition of capital investments, noting that the entire system appeared to be defined by "subjectivity" rather than established accounting principles.

One particularly contentious aspect involves the reclassification of what critics often describe as "corporate welfare" programs as "capital investments." This includes production subsidies and "capital-focused corporate income tax incentives" similar to those that formed the basis of multi-billion dollar agreements with electric vehicle companies during the final months of Justin Trudeau's administration.

Implications for Fiscal Transparency

The fundamental concern raised by the budget watchdog centers on whether this unconventional definition of capital spending effectively masks billions of dollars in operational expenses that would typically be subject to different budgetary scrutiny. By classifying subsidies and tax credits as capital investments, the government may be creating the appearance of greater fiscal discipline than actually exists.

This accounting approach raises important questions about international comparability of Canada's fiscal metrics and whether the country's budget reporting aligns with global standards. As Jacques emphasized in his testimony, no other advanced economy employs such a broad definition of capital spending, potentially isolating Canada's accounting practices from international norms.

The ongoing debate highlights the tension between political messaging about investment and the technical realities of government accounting. While the Carney government presents its approach as innovative budgeting focused on long-term growth, the Parliamentary Budget Officer's analysis suggests it may represent a departure from established fiscal transparency standards observed by Canada's international peers.