Bank of Canada Research Points to Import Costs as Primary Driver of Food Inflation

New research from the Bank of Canada indicates that the acceleration in food inflation throughout 2025 was almost entirely attributable to rising import costs, rather than domestic economic factors. The findings, released in a detailed report, provide crucial insights into the pressures facing Canadian consumers at the grocery store.

Quantifying the Impact of International Factors

According to the central bank's analysis, the total annual change in food costs—excluding the volatile categories of fruits and vegetables—was 3.1 percent in 2025. Notably, 2.7 percentage points of that increase stemmed directly from three key international components: direct imports, imported inputs used in domestic production, and elevated international shipping costs. This breakdown underscores how global supply chain dynamics have disproportionately influenced price trends within Canada.

Currency Depreciation and Specific Commodity Pressures

Senior economist Olga Bilyk, author of the report, highlighted that prices for imported food began rising early in the year, partly due to the significant depreciation of the Canadian dollar in late 2024. The research further identifies specific categories that experienced sharp price hikes. For instance, coffee prices surged by 31 percent, while confectionery items like chocolate and candy increased by 14 percent by the end of last year.

Bilyk explained that both coffee and confectionery were affected by supply shortages caused by extreme weather events and the imposition of trade tariffs. These factors created a perfect storm that drove costs upward for Canadian importers and, ultimately, consumers.

Trade Dynamics and Political Context

The report contextualizes these trends within broader trade relations. Last year, former United States President Donald Trump implemented major tariffs on imports from Brazil, including key items like beef and coffee. Although his administration has begun to reverse some of these levies amid pressure to reduce everyday costs, the initial tariffs disrupted supply chains.

Canada and the U.S. maintain closely connected food supply networks, with many Canadian importers sourcing products from American wholesalers and warehouses. For several months in 2025, Canada also imposed retaliatory tariffs on select U.S. food items, including coffee and orange juice, further complicating the trade landscape and contributing to price increases.

Broader Inflation Data and Political Reactions

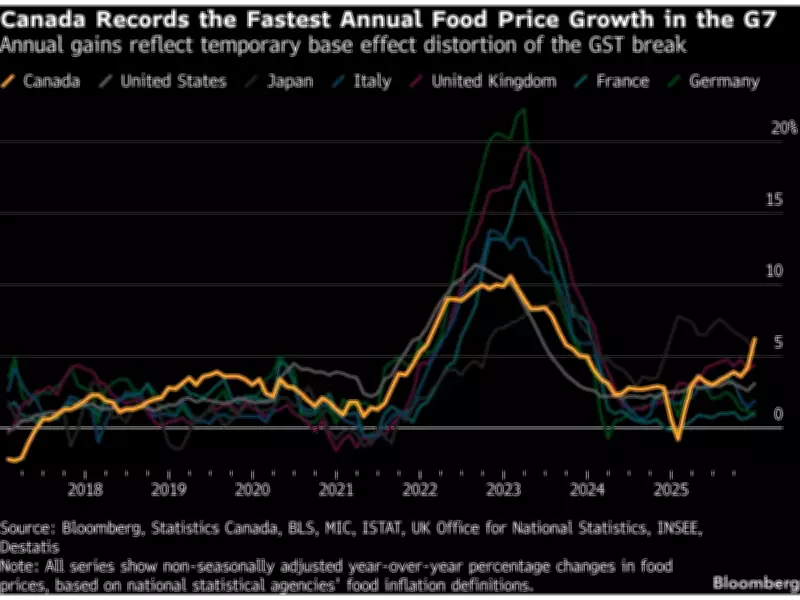

Statistics Canada data released last month showed that food prices rose by 6.2 percent between December 2024 and December 2025, marking the fastest pace of increase among Group of Seven nations. While this figure is temporarily distorted by a base-year effect linked to last winter's goods and services tax (GST) holiday, it has become a focal point in political debates.

Conservative Leader Pierre Poilievre has leveraged the data to criticize the government's affordability record. The Conservative Party of Canada asserted in a news release that hidden Liberal taxes raise the cost at every step of the supply chain, from farm equipment to shipping. In response, Prime Minister Mark Carney recently announced plans to enhance a GST credit for low- and moderate-income Canadians, dubbed the Canada Groceries and Essentials Benefit, to help mitigate rising living costs.

Methodological Notes and Future Implications

The Bank of Canada's analysis deliberately excludes fruits and vegetables due to their price volatility, which often reflects rapidly changing weather conditions. This methodological choice allows for a clearer assessment of underlying inflationary trends driven by structural factors like trade and currency fluctuations.

As the parliamentary budget officer estimates the total cost of the expanded GST credit program at $12.4 billion by 2030-31, the research underscores the ongoing challenge of balancing domestic policy responses with uncontrollable international market forces. The findings highlight how global economic shifts continue to shape the cost of living for Canadians, emphasizing the need for nuanced policy approaches in an interconnected world.