Bank of Canada Research Points to Import Costs as Primary Driver of Food Inflation

New research from the Bank of Canada indicates that the acceleration in food inflation throughout 2025 was almost entirely attributable to rising import costs, rather than domestic economic factors. The findings challenge some political narratives about the origins of grocery price increases and provide detailed analysis of the international pressures affecting Canadian consumers.

Quantifying the Import Impact on Food Prices

According to the central bank's research released Tuesday, the total annual change in food costs (excluding fruits and vegetables) reached 3.1% in 2025. Remarkably, 2.7 percentage points of that increase stemmed directly from three international factors: direct imports, imported inputs, and international shipping costs. This means approximately 87% of the food inflation measured in the study originated beyond Canada's borders.

Senior economist Olga Bilyk, author of the report, explained that "prices for imported food began rising early in the year, partly due to the significant depreciation of the Canadian dollar in late 2024." This currency dynamic made all imported food products more expensive for Canadian buyers, creating upward pressure on grocery bills throughout the supply chain.

Specific Commodities Hit Hard by International Factors

The research highlights particular food categories that experienced dramatic price increases:

- Coffee prices surged 31% by the end of 2025

- Confectionery items (including chocolate and candy) rose 14% during the same period

Bilyk noted that "both items were affected by supply shortages — caused by issues such as extreme weather — and trade tariffs." These international disruptions created perfect storms for specific commodity markets, with effects that rippled through to Canadian consumers.

Trade Policy Complications in North American Supply Chains

The research context includes significant trade policy developments that affected food imports. Last year, former U.S. President Donald Trump imposed major tariffs on imports from Brazil, including key agricultural products like beef and coffee. While these tariffs have begun to be reversed amid political pressure to reduce consumer costs, their initial implementation disrupted established supply patterns.

Canada's deeply integrated food supply chains with the United States meant these disruptions had immediate consequences. Many Canadian importers source products from U.S. wholesalers and warehouses, creating vulnerability to American trade policy decisions. Additionally, for several months in 2025, Canada implemented retaliatory tariffs on some U.S. food items, including coffee and orange juice, further complicating cross-border food trade.

Methodological Considerations and Broader Context

The Bank of Canada analysis deliberately excluded fruits and vegetables from its calculations because their prices exhibit high volatility, primarily reflecting frequently changing weather conditions rather than structural economic factors. This methodological choice allows for clearer analysis of underlying inflation trends beyond seasonal fluctuations.

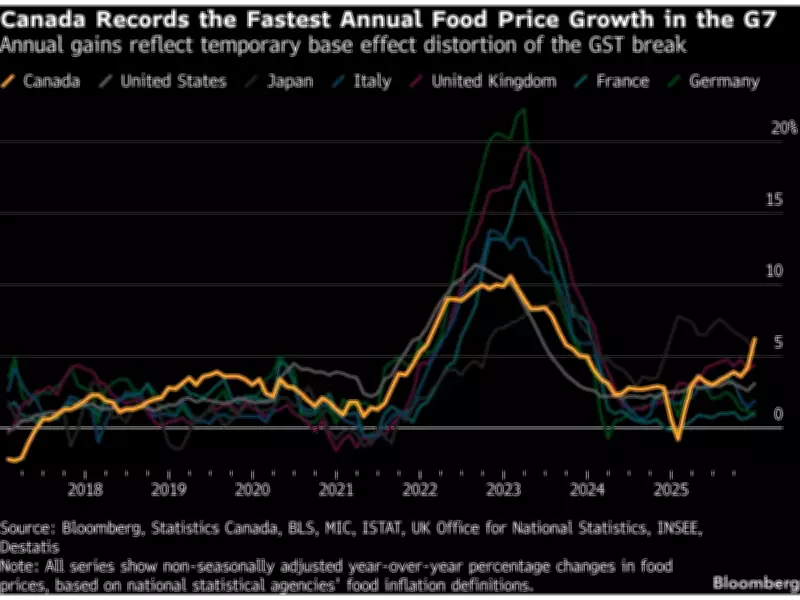

Broader Statistics Canada data reveals that food prices increased by 6.2% between December 2024 and December 2025 — the fastest pace of increase among Group of Seven nations. This figure is temporarily distorted by a base-year effect related to last winter's goods and services tax (GST) holiday, but nonetheless reflects significant consumer pressure.

Political Responses and Policy Developments

The inflation data has become politically contentious, with Conservative Leader Pierre Poilievre using the statistics to criticize the government's affordability record. The Conservative Party of Canada asserted in a Tuesday news release that "the Liberals keep denying that their policies drive up grocery bills, but Canadians know this is a made-in-Canada problem," claiming that "hidden Liberal taxes raise the cost at every step of the supply chain."

In response to rising living costs, Prime Minister Mark Carney announced last week that his government plans to enhance a GST credit for low- and moderate-income Canadians, rebranding it as the Canada Groceries and Essentials Benefit. The expanded program includes:

- A one-time transfer to eligible Canadians this year

- An increase in the annual credit over a five-year period

The Parliamentary Budget Officer estimated on Monday that the total cost of this program will reach approximately C$12.4 billion ($9.1 billion) by 2030-31, representing a significant fiscal commitment to address consumer affordability concerns.

The Bank of Canada research provides crucial evidence that international factors — particularly import costs, currency fluctuations, and trade policies — played the dominant role in 2025's food inflation acceleration. These findings offer important context for ongoing policy debates about how best to address the cost of living challenges facing Canadian households.