Parliamentary Budget Officer Releases Cost Analysis of Federal GST Relief Proposal

The Parliamentary Budget Officer (PBO) has released a detailed financial analysis projecting that the federal government's proposed Goods and Services Tax (GST) relief plan will cost approximately $12.4 billion over a five-year period. This significant fiscal projection comes as Prime Minister Mark Carney continues to promote the economic measures designed to provide financial relief to Canadian households and businesses.

Substantial Financial Commitment for Consumer Relief

According to the independent parliamentary office's calculations, the GST relief initiative represents a substantial financial commitment from the federal treasury. The $12.4 billion projection covers the period from 2026 through 2030, with the costs distributed across multiple fiscal years as the proposed measures would be implemented gradually.

The PBO's analysis provides crucial transparency about the long-term financial implications of the government's proposed tax policy changes. This detailed costing information allows parliamentarians and the public to better understand the trade-offs involved in implementing such broad-based consumer tax relief measures.

Prime Minister's Advocacy for Economic Support Measures

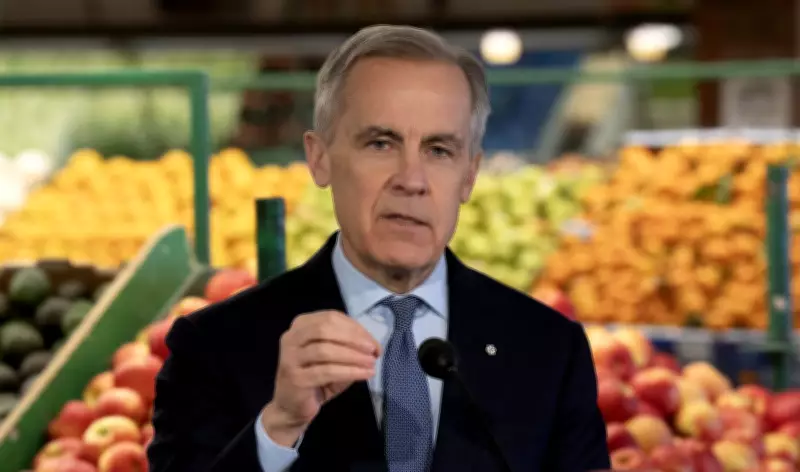

Prime Minister Mark Carney has been actively promoting the GST relief proposal as part of his government's broader economic agenda. In late January 2026, Carney participated in a media event at an Ottawa grocery store where he emphasized how the tax relief would help Canadian families manage rising living costs.

"This GST relief represents a meaningful way to put money back in the pockets of Canadians who are feeling the pressure of inflation and economic uncertainty," Carney stated during the Ottawa appearance. "Our government believes that targeted tax relief can provide immediate assistance while supporting broader economic stability."

Policy Context and Implementation Timeline

The proposed GST relief measures would represent one of the most significant consumer tax adjustments in recent federal policy. The PBO's five-year costing projection suggests that:

- The relief would be implemented through either temporary rate reductions or expanded exemptions

- The financial impact would increase gradually as the measures take full effect

- The $12.4 billion represents net revenue loss to the federal government

- Additional provincial implications may exist depending on harmonization arrangements

The detailed costing report comes at a critical time as Parliament prepares to debate the government's upcoming budget legislation. Opposition parties and economic analysts are expected to scrutinize both the financial projections and the proposed policy's effectiveness in achieving its stated objectives of consumer relief and economic stimulus.

Broader Economic Implications and Fiscal Considerations

Beyond the direct $12.4 billion cost projection, the PBO's analysis raises important questions about the plan's broader economic implications. Fiscal policy experts note that such significant tax relief measures must be balanced against other government priorities and potential impacts on the federal deficit.

The government has indicated that the GST relief would be partially offset by revenue measures elsewhere in the budget, though the PBO's analysis focuses specifically on the direct costs of the tax reduction proposal itself. As the parliamentary debate intensifies, the $12.4 billion figure will likely become a central point of discussion about fiscal responsibility and economic policy priorities.