As the year 2025 draws to a close, financial columnist Garry Marr has distilled the turbulent economic period into five crucial lessons for investors. Published on December 31, 2025, his analysis serves as a strategic guide for navigating future financial landscapes.

Navigating Government Policy Whiplash

One of the most critical warnings from Marr's review is the need for investors to be acutely aware of government policy whiplash. The past year demonstrated how sudden shifts in fiscal and monetary policy can create volatility and upend market expectations. Savvy investors must remain agile and factor potential regulatory changes into their long-term strategies.

The Enduring Strength of Banking Investments

A cornerstone of Marr's advice is the recommendation to always invest in the banks. Despite economic fluctuations, the Canadian banking sector has repeatedly proven its resilience and capacity for stable returns. This lesson underscores the value of foundational, blue-chip investments in a well-balanced portfolio.

Key Takeaways for the Astute Investor

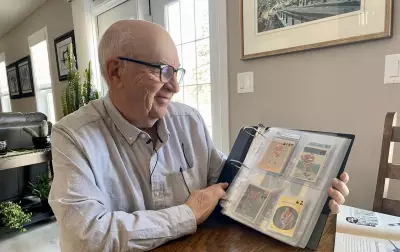

Marr's lessons are born from observing the financial events of the last 365 days, a period rich with learning opportunities. He emphasizes that the insights we integrate from such periods can define our financial outcomes for years to come. His direct contact for readers is gmarr@postmedia.com.

The original article, accompanied by an explanatory video, was featured as exclusive subscriber content. It highlighted the value of resources like daily insights from the Financial Times and analysis from prominent journalists including Barbara Shecter, Joe O'Connor, and Gabriel Friedman.

For Canadian investors, Marr's synthesis is more than a year-end review; it's a pragmatic framework for building wealth amidst uncertainty. His focus on core principles—like understanding macro policy and trusting in established financial institutions—provides a clear path forward.