In a seismic shift for the entertainment industry, streaming giant Netflix has finalized an agreement to purchase the television and film studios and streaming division of Warner Bros Discovery. The landmark deal, valued at $72 billion, was announced on Friday, December 5, and would transfer control of one of Hollywood's most storied assets to the company that pioneered the streaming revolution.

The Bidding War and Deal Structure

The agreement concludes a weeks-long bidding war. Netflix emerged victorious with an offer of nearly $28 per share, surpassing a rival bid of around $24 per share from Paramount Skydance for the entirety of Warner Bros Discovery. Warner Bros Discovery shares had closed at $24.50 on Thursday, giving the company a market valuation of approximately $61 billion prior to the announcement.

Under the terms, each Warner Bros Discovery shareholder will receive $23.25 in cash and roughly $4.50 in Netflix stock per share. This values Warner at $27.75 per share, representing an equity value of about $72 billion and a total enterprise value of $82.7 billion when debt is included. Netflix shares dipped nearly 3% in premarket trading following the news.

Reshaping the Media Landscape

This acquisition dramatically alters the balance of power in Hollywood. Netflix, which built its dominance primarily through original content rather than major acquisitions, will now gain control of iconic franchises including "Game of Thrones," "DC Comics," and "Harry Potter." The move significantly bolsters Netflix's content library as it seeks to fend off competition from giants like Walt Disney and the Ellison family-backed Paramount.

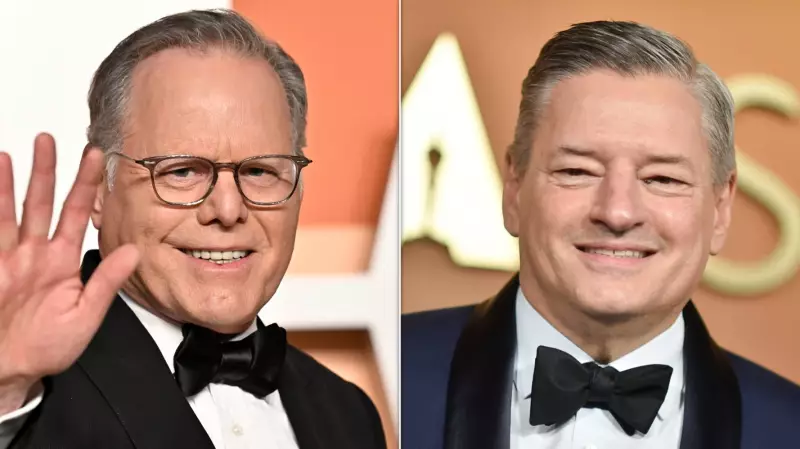

"Together, we can give audiences more of what they love and help define the next century of storytelling," stated Netflix co-CEO Ted Sarandos. The company anticipates generating $2 billion to $3 billion in annual cost savings by the third year after the deal closes.

To address concerns from the film industry, Netflix has assured Warner Bros Discovery that it will continue to release the studio's films in cinemas, aiming to calm fears about losing a major source of theatrical content.

Antitrust Hurdles and Competitive Concerns

The colossal deal is expected to face intense antitrust scrutiny from regulators in both the United States and Europe. The transaction would combine the world's largest streaming service with a key rival, HBO Max, which boasts nearly 130 million streaming subscribers.

Paramount, which initiated the bidding war, has already questioned the sale process, alleging favorable treatment toward Netflix in a letter earlier this week. In deal talks, Netflix argued that combining its service with HBO Max could benefit consumers by potentially lowering the cost of a bundled offering, according to a Reuters report.

The acquisition is slated to close after Warner Bros Discovery completes the spinoff of its global networks unit, Discovery Global, into a separate publicly traded company. This move is currently scheduled for completion in the third quarter of 2026.