A joint bid by two of Canada's wealthiest dynasties, the Thomson and Weston families, to acquire the historic 1670 Royal Charter of the Hudson's Bay Company has proceeded without competition, clearing the path for the landmark document's sale. Sources confirm that no rival offers were submitted against the $18 million proposal from the families' private investment vehicles.

The Path to a Joint Bid

The uncontested offer marks the culmination of a months-long process. Hudson's Bay Company, the defunct retailer, initially sought to sell the charter as part of its efforts to repay creditors after seeking court protection earlier this year. In June, HBC announced a deal to sell the charter to Wittington Investments Ltd., controlled by the Weston family, for $12.5 million.

However, the situation changed in August when DKRT Family Corp., owned by David Thomson (ranked as Canada's richest individual), submitted a competing offer of at least $15 million. This development led to the court-sanctioned auction process, scheduled for the first week of December. Ultimately, the two parties joined forces, presenting a unified bid that guaranteed HBC a higher price, which translates to potentially greater recoveries for the company's creditors.

Preserving a National Artifact

The successful acquisition is not for private collection. The joint bidders have committed to donating the Royal Charter to a consortium of four major Canadian public institutions. The document will find a permanent home shared among the Archives of Manitoba, the Manitoba Museum, the Canadian Museum of History, and the Royal Ontario Museum.

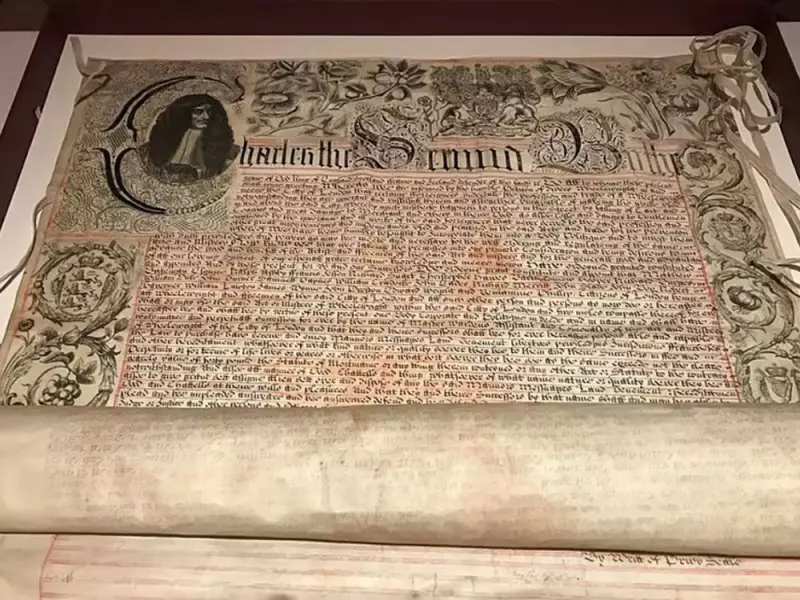

The charter itself is a foundational piece of Canadian history. Issued by King Charles II in 1670, it granted the Hudson's Bay Company exclusive trading rights and governance over Rupert's Land, a vast territory encompassing much of present-day central and northern Canada. Its sale has attracted significant public interest due to this profound historical significance.

Winding Down HBC's Legacy Assets

The charter sale is one component of HBC's broader asset liquidation strategy. The company is also in the process of selling other historical artifacts from its collection. Previously, it has disposed of its intellectual property rights and various leases. Each sale is directed towards satisfying creditor claims as the historic company winds down its operations under court supervision.

With no competing bids filed by the deadline, the joint offer from the Thomson and Weston families is set to be finalized. This ensures that a pivotal document in the nation's commercial and territorial development will be preserved and made accessible to the public through Canada's leading museums.