Ontario Housing Crisis Spurs Urgent Call for Three-Year HST Holiday on New Home Construction

Construction industry leaders in Ontario are making an urgent appeal to both provincial and federal governments to implement a three-year harmonized sales tax (HST) holiday on new home construction. This bold proposal aims to revitalize the province's struggling housing sector and address the deepening housing crisis.

Industry Coalition Backs Tax Relief Proposal

The Residential and Civil Construction Alliance of Ontario (RCCAO) and the Residential Construction Council of Ontario (RESCON) have jointly called for immediate government action. Their proposal is supported by comprehensive economic analysis conducted by the Canadian Centre for Economic Analysis (CANCEA), which demonstrates that the three-year tax holiday would be statistically revenue-neutral for all levels of government.

"Ontario's housing crisis is worsening and prolonged job-losses risk adding to long-term problems plaguing the sector," emphasized Nadia Todorova, Executive Director of RCCAO. "The men and women in the skilled trades need to see urgent government action to improve market conditions in the sector so they can get back to building desperately needed homes across Ontario."

Economic Analysis Reveals Multiple Benefits

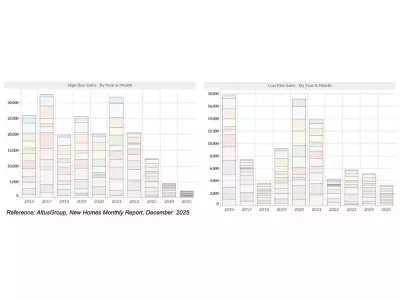

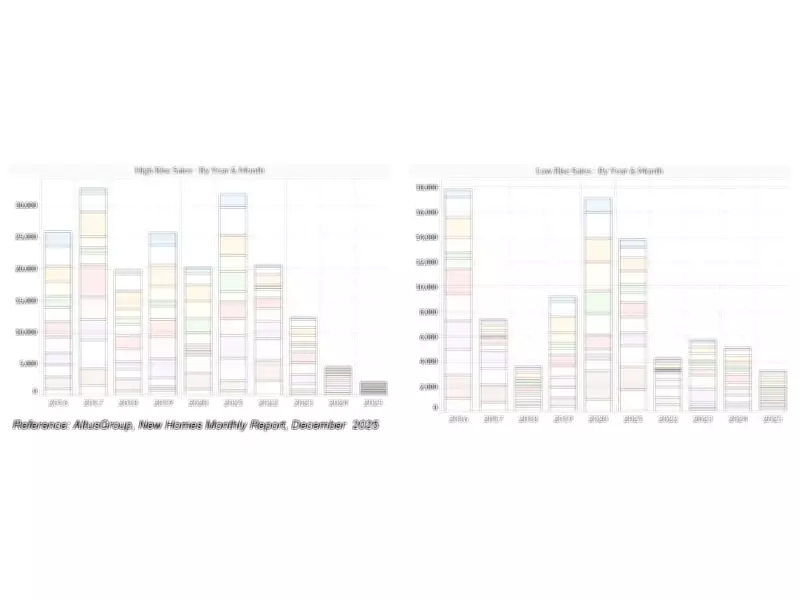

The CANCEA research supporting this policy initiative found that a three-year HST holiday would deliver significant advantages:

- Preserve approximately 26,000 direct industry jobs in skilled trades

- Create economic urgency in the market to incentivize buyers to purchase new homes

- Generate $3.9 billion in GDP contributions to Ontario's economy

- Maintain revenue neutrality for all government levels

"Our governments tax homes at the same level of alcohol and tobacco," noted Richard Lyall, President of RESCON. "We need fast action to provide tax relief to kickstart Ontario's housing industry back into building. A three-year HST holiday would help reverse market conditions devastating the industry."

High Taxes Exacerbating Housing Shortages

Industry representatives argue that current high taxes on new home construction are worsening Ontario's housing crisis. They contend that meaningful tax relief is essential to jumpstart the collapsed housing sector and address the critical shortage of available homes across the province.

The construction groups are urging swift implementation through the upcoming 2026 provincial budget, with parallel action from the federal government. They also emphasize the importance of passing Bill C-4 in the Senate of Canada and securing Royal Assent to support broader housing initiatives.

Research-Based Advocacy for Infrastructure Investment

RCCAO, established in 2005, has been a leading industry advocate for infrastructure investment, having commissioned 64 independent, solutions-based research reports to inform policy decisions. The organization represents a labour-management construction alliance committed to addressing Ontario's infrastructure and housing challenges through evidence-based solutions.

The complete CANCEA economic analysis detailing the proposed tax scenarios is available through RCCAO's research publications, providing comprehensive data supporting the call for immediate tax relief measures to address Ontario's housing emergency.