Elevra Lithium Announces Strong Quarterly Results with Record Revenue

Elevra Lithium Limited, a prominent player in the global lithium sector, has released its quarterly activities report for the period ending December 2025. The company, which trades on the ASX, NASDAQ, and OTCQB, reported significant financial and operational milestones at its North American Lithium (NAL) facility in Australia, alongside updates on its growth projects worldwide.

NAL Operations Achieve Record Revenue and Gross Profit

During the December 2025 quarter, Elevra Lithium delivered record quarterly revenue and generated a gross profit at NAL, marking the second time since operations recommenced in 2023. This achievement underscores the company's resilience in a dynamic market environment. The average realized selling price for spodumene concentrate increased by 27% to US$998 per dry metric tonne, reflecting improved lithium market fundamentals and Elevra's exposure to rising spot prices.

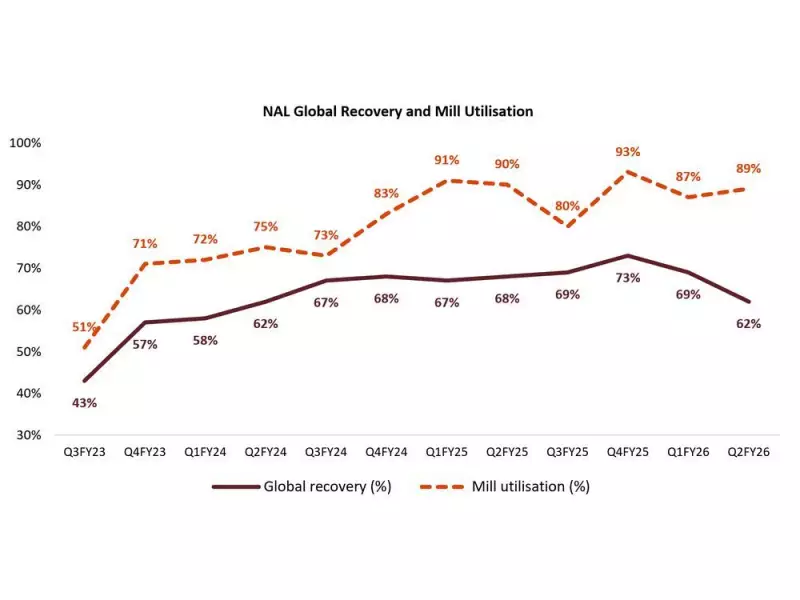

Operational highlights from NAL include a 15% quarter-on-quarter increase in ore mined, reaching 389,801 wet metric tonnes. Process plant utilization improved to 89%, up 2% from the previous quarter. However, lithium recovery declined by 7% to 62%, primarily due to pit development sequencing near historical underground workings, which temporarily lowered feed grade and increased iron content in the material.

Spodumene concentrate production decreased by 15% to 44,154 dry metric tonnes at an average grade of 4.9%. This reduction was attributed to the lower lithium recovery and the need for increased use of wet high-intensity magnetic separators to manage higher iron content. Despite this, spodumene sales totaled 66,016 dry metric tonnes, aligning with prior guidance to weight sales toward the December quarter.

Financial and Corporate Updates

Unit operating costs at NAL saw a modest decrease to US$812 per tonne sold, compared to US$818 in the prior quarter, contributing to the gross profit. Capital expenditure for the quarter was US$7 million, on budget, with funds allocated to upgrading the Tailings Storage Facility and other sustaining projects. At the quarter's end, Elevra held US$81 million in cash, though this was impacted by change-of-control payments and merger-related advisory fees.

On the corporate front, Elevra appointed Christian Cortes as Chief Financial Officer during the quarter, reinforcing the company's operational focus. All resolutions passed at the Annual General Meeting on November 21, 2025, including the election of four ex-Piedmont directors. Merger-related cost synergies remain on track, with an update expected in the HY26 Interim Results in late February 2026.

Revised Production Guidance and Growth Projects

Elevra has revised its FY26 production, sales, and cost guidance after reviewing half-year results, adopting a more conservative outlook for the upcoming quarters. The company believes it prudent to lower production guidance in the short term until benefits from increased grade control drilling and improved ore blending are realized. This adjustment applies only to near-term guidance, as current operational conditions are not representative of the NAL Life of Mine orebody.

Following the quarter's end, Elevra issued an update on the NAL Expansion, outlining an accelerated timeline to boost annual production and reduce unit operating costs through a phased approach. This strategic move aims to enhance long-term profitability and operational efficiency.

Progress on Global Growth Initiatives

Elevra's growth projects showed steady advancement during the quarter. At the Moblan project, planned baseline environmental field activities were undertaken, and studies progressed. In Ghana, ratification of the Ewoyaa Mining Lease by Parliament is ongoing, with project advancement contingent on this approval, market conditions, and suitable financing.

In the United States, the Carolina Lithium project obtained General Stormwater Permits for the proposed mine and conversion plant, marking key environmental permitting milestones. Elevra engaged with local officials, community stakeholders, and US government agencies to discuss the project's strategic importance to a domestic lithium supply chain, highlighting its role in supporting North American energy independence.

Overall, Elevra Lithium's quarterly report reflects a blend of strong financial performance and strategic adjustments to navigate operational challenges, positioning the company for sustained growth in the evolving lithium market.