When Toronto resident Lisa McIntyre checked her credit score recently, she experienced every Canadian consumer's worst nightmare. What should have been a routine financial checkup revealed a shocking 200-point drop that threatened to derail her financial future.

The Bill That Never Arrived

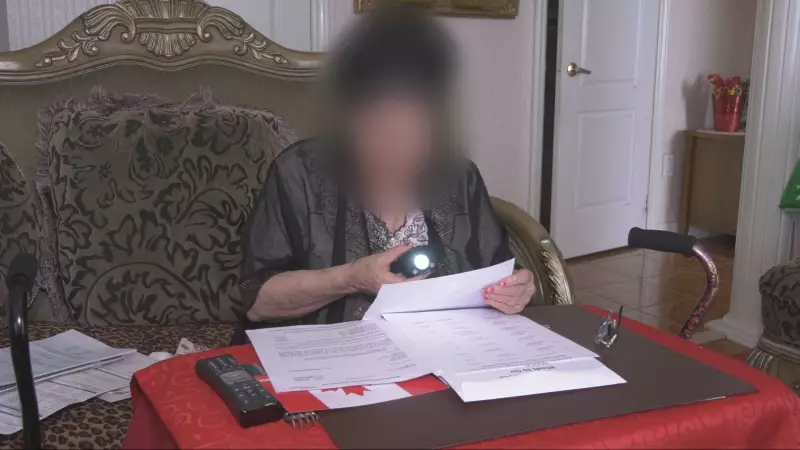

"I never thought they were going to destroy my credit score over one bill," McIntyre told CTV News Toronto, her voice still filled with disbelief. The catastrophic drop stemmed from a single unpaid Rogers bill for $67 - a bill she insists she never received in the mail.

How One Small Bill Created Massive Financial Fallout

The seemingly minor oversight triggered a chain reaction that demonstrates just how fragile credit systems can be:

- Her credit score dropped from excellent to fair territory

- The negative mark appeared without prior warning from collections

- Future loan applications could now face higher interest rates or rejection

- Rental applications and even employment opportunities could be affected

The Silent Credit Score Killer

McIntyre's case highlights a common but often overlooked danger in Canada's credit system. "It's frightening how one small bill you didn't even know about can have such devastating consequences," she explained. The incident occurred despite her otherwise impeccable payment history and responsible financial behavior.

Protecting Your Credit: Essential Steps Every Canadian Should Take

Financial experts recommend several proactive measures to prevent similar credit catastrophes:

- Regularly monitor your credit report through services like Borrowell or Credit Karma

- Set up payment reminders for all recurring bills

- Verify address changes with all service providers when you move

- Dispute errors immediately with both the creditor and credit bureaus

- Consider automatic payments for essential services

Fighting Back Against Credit Reporting Errors

After discovering the damage, McIntyre took immediate action by contacting both Rogers and the credit reporting agencies. Her experience serves as a crucial reminder that consumers have rights when it comes to credit reporting accuracy.

"Your credit score is your financial reputation," McIntyre emphasized. "We need to be more aware and protective of it because it can change in an instant over something you didn't even know existed."

Her story underscores the importance of vigilance in an increasingly digital financial landscape where a single missed communication can have long-lasting consequences on your financial wellbeing.